By Mike Huml

The U.S. Food and Drug Administration’s (FDA) dreaded deadline for its premarket tobacco product application (PMTA) has come and gone after multiple delays. With all that’s happened this year, it may have gone unnoticed for many. Rest assured that the process of submitting a PMTA has been long and tedious for manufacturers and vendors alike, and they have been working hard to ensure that reduced-risk products remain available for as long as possible.

Many companies have been working tirelessly to submit their applications, but the process is fairly opaque and uncertain. The filing of the PMTA does not ensure FDA acceptance, and each product must be filed separately. Currently, it is largely unknown which specific products have been submitted for FDA approval.

What is known, however, is which companies intend to submit or have already submitted a PMTA and how far along they are in the process. Keep in mind that being further along in the approval process is not necessarily an indicator of success. No vapor company at the time of this writing has received FDA approval for any product, and the length of time each submission will remain within the approval process is unknown. With so many unknowns, it can be difficult to predict which products will be legal to carry, if any. By looking at which companies are taking part in the PMTA process along with their histories, one can make reasonable assumptions as to which direction the vapor industry will begin to sway.

First, the bad news. Given that each PMTA is only valid for one “distinct new tobacco product,” and that even the smallest difference in the design of a product could warrant an entirely new SKU, it’s only reasonable to assume that there will be massive consolidation of vapor products. Products that are too similar will need to reconcile, either by being discontinued or redesigned. Even identical products with different colors, flavors, resistances or nicotine strengths could be considered separate SKUs, with each requiring its own PMTA, which has proven to be prohibitively expensive.

The massively varied choices that vapers have in products is undoubtedly going to shrink, but by what degree? A mod is considered one SKU, and an atomizer or tank is considered another. If the mod requires separate batteries, those are also considered an SKU, which requires FDA approval. Said batteries require a charger; that’s another SKU. If the mod and the atomizer come as a kit, that would yield yet another SKU. If the atomizer has three coil options of different resistances, that could require three separate PMTA applications. Clearly, this can spiral out of control quickly, so it’s expected that companies will need to streamline their product offerings.

Two parallel philosophies have been playing out over the past several years. One is to throw everything at the wall and see what sticks. Several companies have been releasing an overwhelming number of products in quick succession to try to get a better feel for what works and what does not. PMTAs are expensive, and many companies have adopted the “measure twice, cut once,” mentality. The past 10 years or so have allowed the industry to innovate, unimpeded by government regulation. This innovation naturally plateaued to a point where vapers have enjoyed a few years of refinement.

The technology seen today is not much different from the technology introduced three years ago. The difference is that today’s products have gone through a process of refinement due to the growing population of vapers providing feedback with both their voices and their wallets. It’s been a completely free market up until this point, and while manufacturers have been steadily improving their products, now is the time to lock in the best of the best and commit to the long term by submitting PMTA applications.

The other philosophy is to streamline the product offering, and this can be seen with the popularity of proprietary systems. For example, 510 devices have pretty much stagnated in popularity while pod systems have seen a boom. If a 510 device is compatible with a thousand 510 atomizers, and vice versa, that’s an impossible number of PMTAs, and without an example of a product that has undergone the process, it would be a huge gamble to try to sell the FDA on a device that is compatible with products outside the applicant’s ecosystem.

The prospect of a device such as a 510-compatible atomizer, which is ripe for facilitating the rise of black market mods, could invalidate the PMTA process on that prospect alone. Not only would the applicant be taking a larger risk by submitting a PMTA for a 510 device, but he would also be complicit in the assumed knowledge that he won’t see a return on that PMTA investment if the end user chooses to go outside said applicant’s ecosystem for complementary products. In short, manufacturer X isn’t going to shell out hundreds of thousands of dollars to submit a PMTA for a 510 mod if vaper Y is just going to turn around and buy an atomizer off the black market.

The most likely scenario is that each company is going to submit PMTAs for a line of products that keep the customer within their ecosystem. Whether that’s one type of product or several remains to be seen, but it only makes sense for any company to want to see the highest return on investment possible. Additionally, this is only the first round of PMTAs, and no product has made it successfully through the process.

It’s unlikely that any applicant has already submitted more than a few products for approval. Even with FDA guidance, the industry is figuratively a canary in a coal mine. Until there is a solid example of a product successfully navigating the PMTA process, companies are likely to be conservative in how many products are submitted for approval. Those that do will likely be product types that have proven to be the most profitable and simple.

Pod systems are the most likely products to have already been submitted, along with e-liquids. They’re the most popular products in today’s market and are the easiest to consolidate. There are many pod systems out there, perhaps too many, but for good reason. They appeal to the widest market and ensure that consumers remain within the ecosystem as they keep coming back for replacement coils and pods.

Pod systems are also the most resistant pieces of hardware when it comes to a black market, therefore mitigating any risk for a PMTA rejection based on that premise. Many companies have released multiple pod systems over the years and by now have a good idea of which designs are the best. In terms of hardware, expect to see a pod system as the first “FDA-approved” vapor product.

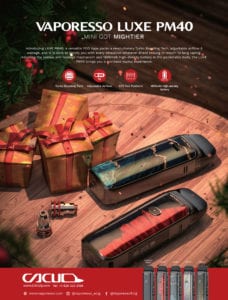

As for specific companies to keep an eye out for, look at the largest companies. Smok, Innokin, Vaporesso, Juul—these manufacturers have been preparing for the PMTA deadline for years and have already submitted applications. In fact, almost all the big names in the vapor industry have submitted applications, including Uwell, HorizonTech, Sigelei, Suorin and others. Currently no PMTA has been approved, but none have been rejected either. These companies have the most resources, motivation and resolve to see this process through to the end.

E-liquid, however, is a completely different animal. It takes much more to create vapor hardware than it does to create e-liquid, and that means that smaller companies have also been submitting PMTAs for e-liquid. Unfortunately, much more consolidation will likely also be occurring. Remember, if only one flavor is available in four nicotine strengths and three bottle sizes, that’s potentially 12 PMTAs for “one” e-liquid. So even though more e-liquid companies are submitting PMTAs than hardware manufacturers, each e-liquid manufacturer will likely have to consolidate much more than a hardware manufacturer. This is also heavily reliant on how the FDA receives the PMTA. Many e-liquid manufacturers have submitted one PMTA for multiple flavors, but the success of this method remains to be seen, and the FDA’s own language is ambiguous:

“A manufacturer could submit one premarket application for multiple tobacco products with a single, combined cover letter and table of contents for each product. However, when [the] FDA receives a premarket submission that covers multiple, distinct new tobacco products, we intend to consider information on each product as a separate, individual PMTA …. [The] FDA considers each ENDS product with a differing flavoring variant or nicotine strength to be a different product.

So will each different nicotine strength of each bottle size require a separate PMTA, or can they be combined? It’s unclear, but some manufacturers such as AMV Holdings are confident that multiple SKUs can be covered by a single PMTA successfully. In a Sept. 9 press release, AMV writes, “AMV has filed an additional 104 PMTA submissions accounting for over 5,000 SKUs.”

However, even if multiple SKUs can be approved by the FDA under a single PMTA, consolidation will still occur, and only the most popular flavors, strengths and sizes will be submitted, at least initially. Given the popularity of pod systems, many manufacturers will likely submit a PMTA for e-liquids that use nicotine salts for a high concentration of the stimulant. Non-nicotine e-liquid is also likely to be among the first wave of submissions as well as one that is medium-strength. The reason being is that if a vaper prefers a nicotine strength of 3 mg, then unofficially the user can mix a higher strength with the non-nicotine e-liquid to achieve the desired strength.

Several well-known e-liquid companies have submitted applications, including Humble Juice Co., Suicide Bunny, Charlie’s Chalk Dust and Beard Vape Co. While the more popular flavors may or may not have been submitted, there are several things that can be expected. First, tobacco and menthol flavors will likely be among the first flavors to receive approval, followed by basic fruit flavors.

Like with nicotine strengths, flavors can be mixed by the end user, and by keeping it simple, mixing becomes much easier. Strawberry mixed with banana is much easier than apple-peach-mango mixed with blueberry mint. Depending on how the FDA treats bottle sizes, those may be consolidated to one size as well. Thirty milliliters is far and away the most popular size bottle for e-liquid, so expect that to become the standard.

As the top level of the vapor industry consolidates its products, so too must the ground level. Doing so in a similar way to manufacturers is the most pragmatic approach. If and when products begin receiving FDA approval, look for three “levels” of products—beginner, intermediate and advanced—with minimal variation for each.

At first, all three levels may be pod systems with varying degrees of advanced features, such as variable wattage, temperature control, etc. Beginner devices like disposables and pod systems, such as the Caliburn G from Uwell (see “Building on Success,” page xx), should take priority because even if they are mostly targeted at new and beginning vapers, advanced users can find value in those products as well.

Intermediate-level products can begin to include features such as variable wattage and a larger battery capacity or e-liquid capacity. These are generally features that are requested by beginners who have had time to use a lower level product and find themselves wanting for more. Perhaps it’s more vapor or just not needing to charge the battery quite as much. Each customer base can vary, but those moving to intermediate devices want “more but better.”

Advanced products are much the same but with generally higher power capabilities, e-liquid capacities, etc. The advanced user will generally know what they are looking for. In the current state of the industry, advanced devices generally include rebuildable atomizers as well, but these are likely not going to be a priority outside of niche markets. There’s a good chance that the first products brought through the PMTA process will be on the simple side, and rebuildables could require a separate PMTA for each type of wire and wick in order to be usable.

The mods most commonly used with rebuildables also tend to have removable batteries, of which there are multiple brands that could, again, each require a PMTA submission. There are quite a few “moving parts,” so to speak, when it comes to advanced vapor devices, and until the industry has a more complete knowledge of how to submit a successful PMTA, the more complicated vapor products will likely be left by the wayside.

The most important thing going forward is to simplify, reduce redundant products and provide a clear advancement pathway for new users. There is massive value in being a one-stop shop for new customers to discover vaping and keep coming back as they progress at their own pace. This may prove much easier throughout the PMTA process as a store owner may very well to be able to pick one manufacturer and stick to it since currently, many products are already similar between companies. Consolidation may also serve to clarify and simplify the development of a product line within a store, making it easier for stores and customers alike.

The PMTA process is grueling and stressful for the entire industry. Although choices may soon become very limited, rest assured that the most reputable names in the business will continue to make their products available. Consolidation is inevitable, but one way or another the burden of choice is about to become much lighter, for better or for worse.