RLX Technology is looking to raise as much as $1.17 billion from a U.S. initial public offering, reports Bloomberg.

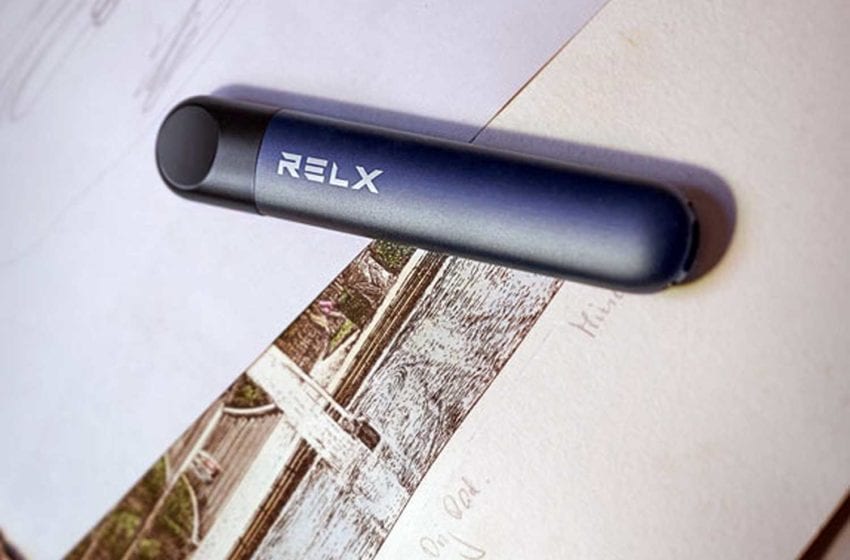

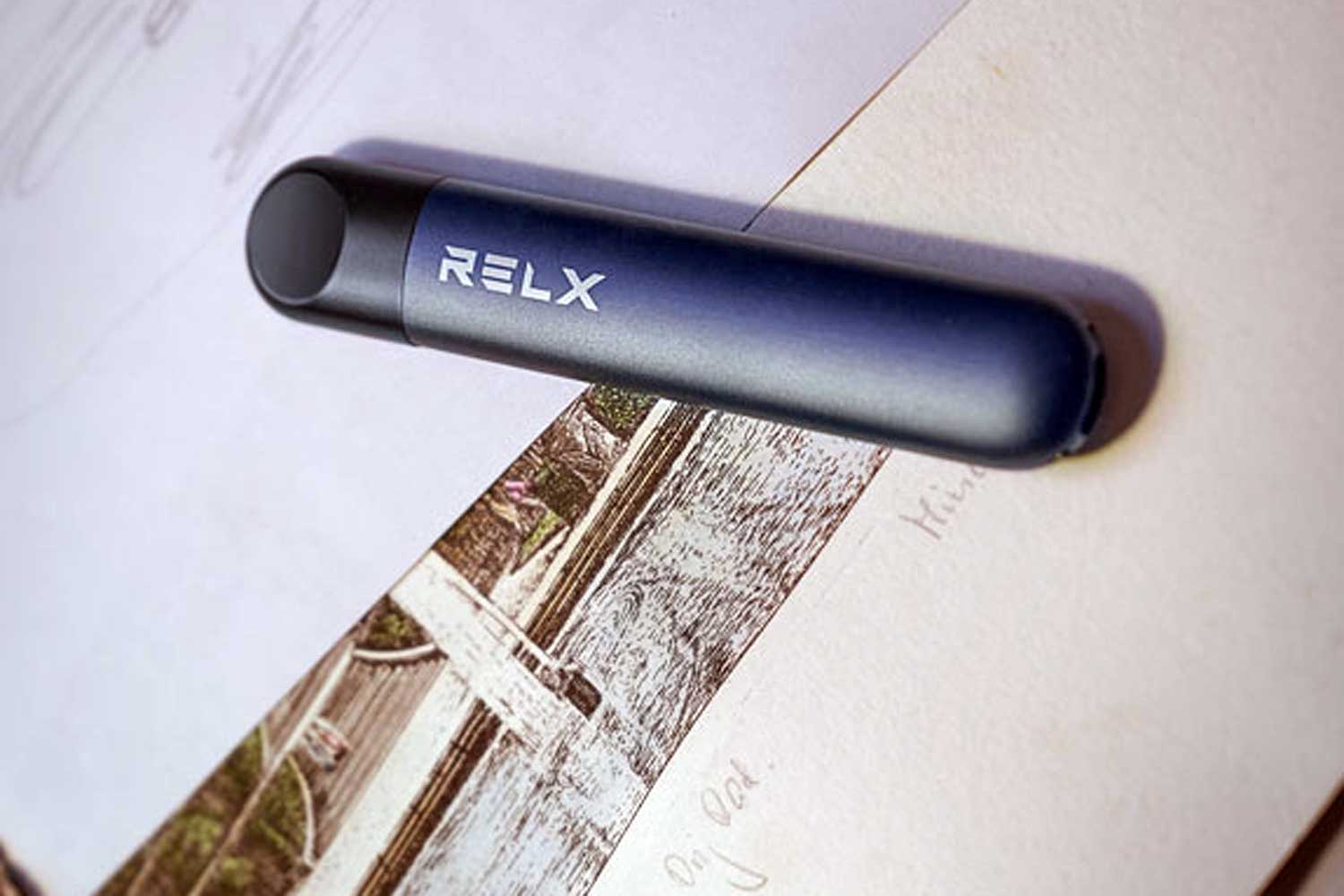

The Chinese vapor company, known for its RELX-branded devices in China, had earlier considered Hong Kong as a listing venue, but it ultimately opted for the U.S.

Founded in 2018, RLX is China’s largest e-cigarette maker. The vaping industry has boomed in China even as the country banned online sales of e-cigarettes just over a year ago. The company said it plans to file a premarket tobacco product application (PMTA) with the U.S. Food and Drug Administration (FDA) to legally sell its products in the world’s largest vapor market.

China is the world’s largest potential vaping market, with an estimated 286.7 million adult smokers in 2019, RLX said in its prospectus. But vaping products only have a 1.2 percent penetration rate, compared with 32.4 percent in the U.S.

RLX’s revenues increased to CNY2.2 billion ($340 million) in the first nine months of 2020 from CNY1.14 billion a year earlier. It started turning a profit in 2019 and recorded net income of CNY109 million in the nine months to Sept. 2020.

The company plans to price the IPO on Jan. 20 after the U.S. market closes, according to a term sheet. Citigroup and China Renaissance are joint bookrunners for the offering.

Earlier reports suggested the company planned to raise up to $100 million in its IPO.