The Covid-19 pandemic slowed the regulatory process in 2020, creating an expected uptick in 2021.

By Chris Howard, special to VV

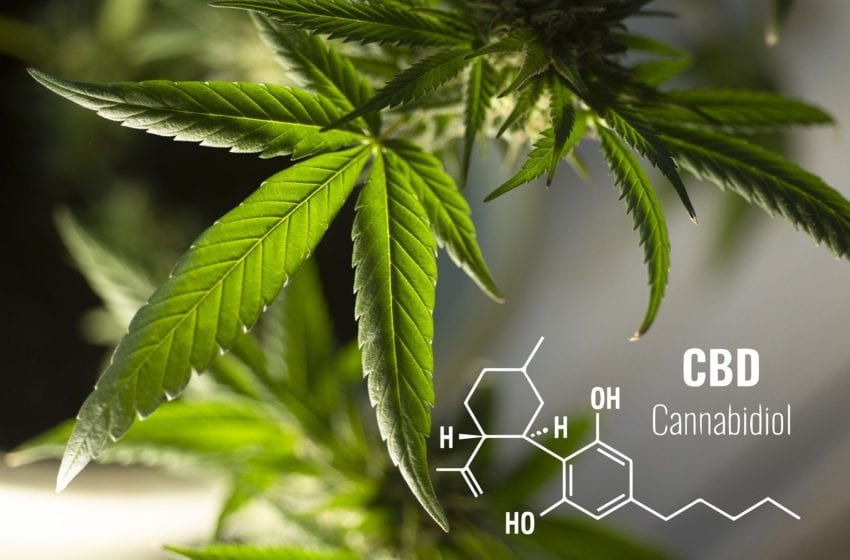

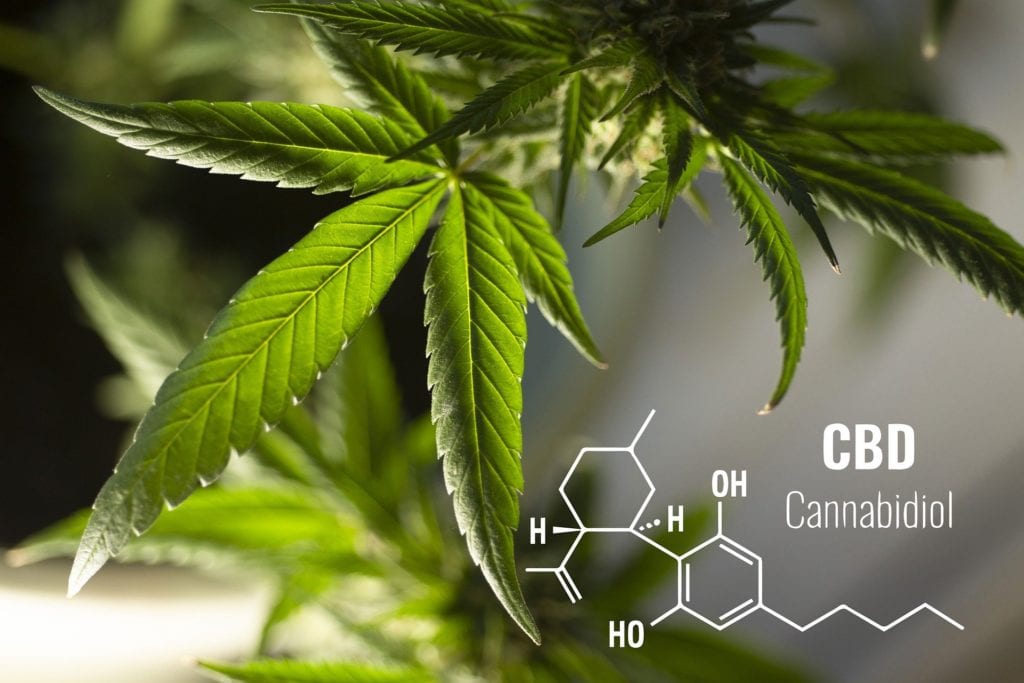

After CBD’s explosive growth in 2019 following the passage of the 2018 Farm Bill that legalized hemp, 2020 began navigation of a regulatory environment in flux. Burgeoning federal and state regulation, as well as increased research into consumer trends and tastes, begins outlining the future of CBD.

The Covid-19 pandemic slowed progress in the U.S. Food and Drug Administration’s (FDA) decision making around CBD, setting up 2021 as a crucial year for the industry, although it is unlikely that any FDA regulations will be finalized this year. Vapor industry veterans, who witnessed the regulatory battles with the FDA, are rightfully wary of the government’s efforts to oversee CBD, but the initial steps seem promising. It is still early days for the CBD industry, and the FDA appears willing to collaborate with the industry on many issues that are important to manufacturers and retailers alike.

As we look ahead, I offer some thoughts on the current CBD market, where regulatory efforts are and finally, what to expect as the CBD space matures.

State of the market

After CBD’s rise to prominence in 2019, last year represented more incremental growth. According to the Brightfield Group, a leading cannabis and CBD market research provider, the United States CBD market grew from $627 million in 2018 to over $4 billion in 2019, an increase of over 650 percent. In 2020, market growth slowed to 14 percent as CBD could be found in more stores and additional uncertainty caused retailers to tread carefully. Despite this recent modest growth, the Brightfield Group projects the CBD market will continue to grow from $4.7 billion in 2020 to nearly $15 billion by 2024.

Driving this growth is a mixture of increased consumer awareness and interest as well as improved access. Sales continue to increase in key market areas, especially e-commerce, creating more competition for CBD specialty stores and vape shops selling these products. C-stores were previously well positioned to capitalize on the market, but research from Technomic, a management consulting company, shows that consumers are being selective where they shop to better hand-pick CBD products.

Consumer form factor preference (the types of products available containing CBD) has been another important area of analysis. Tinctures remain popular, especially with new CBD users. Lotions have become a huge source of interest for consumers with many over-the-counter topical, beauty and skin care companies investing heavily in these products. Refining offerings will be a key part of crafting common sense regulation and helping CBD companies make more confident investments in their product lines.

Regulations in 2021

It is no surprise that the FDA took significant interest in CBD as it quickly grew from an industry valued in the hundreds of millions to one worth billions. Yet, the agency has been slow to definitively rule on any regulations apart from taking a firm stance against companies making therapeutic or health claims, especially during the pandemic.

Where does that leave us now? The FDA’s studies into CBD are ongoing, both analyzing the effects of the compound as well as auditing the contents of current products, although progress has slowed due to Covid-19. Meanwhile, there remains some pressure from congress to create policy around CBD to act as a stopgap while the FDA creates long-term guidance.

I remain optimistic that the FDA will introduce a framework for the specific purpose of regulating products containing CBD that permits the marketing and sale of all form factors in the U.S. This includes food and dietary supplements, a source of much back and forth between CBD advocates and regulators. That said, it is unlikely that a rule will be finalized in 2021. I expect this to be subject to a lot of discussion this year. We will find out more based on how the Biden administration addresses CBD in the year ahead.

In the meantime, CBD companies are forced to navigate a labyrinth of state-by-state regulations. CSP and Grocery Business research indicates 46 states have created CBD laws. State laws can run directly counter to existing federal guidelines, such as those concerning food and beverage products—which are prohibited federally but which are permissible for sale within some states. The patchwork created by these various regulations continues to make national distribution of CBD products a challenge and in some cases even threatens the supply chain of hemp growers and manufacturers.

Looking ahead

While we await final FDA guidance on CBD, I see companies in this industry dealing with many of the same issues we’ve seen over the years in the vapor industry.

The cost of entry for many in the space will become increasingly burdensome once the FDA begins setting regulations, forcing many smaller CBD companies to exit the market. This is similar to what we have seen with PMTAs in vapor, where the larger companies have been far more well equipped to maintain a compliant product selection.

Although it has not been a concern yet, CBD companies should remain mindful and vigilant to ensure that they are taking the necessary steps to prevent youth use of CBD products. Taking a proactive stance now and preventing youth use will help avoid many of the issues faced by the vapor category over the past two years.

Although there are many complex considerations with CBD, it is hard not to get excited about this industry’s future. With continued strong market growth and an apparent pathway to sensible regulation from the FDA for sellers and consumers alike, the future remains bright. In 2021, I hope to see more progress from regulators as we continue to create a strong framework that will work to the benefit this industry and consumers for years to come.

Chris Howard is vice president, general counsel and chief compliance officer for E-Alternative Solutions.