Tobacco Bill Would Tax Vapor Same as Combustibles

- News This Week Taxation

- September 15, 2021

- 5 minutes read

Credit: TS Donahue

The proposed U.S. Tobacco Tax Equity (TTE) Act would tax vaping products the same as combustible cigarettes. According to research from the Tax Foundation, an independent tax policy nonprofit, the proposal would double the rates on combustible cigarettes and increase the rates on all other tobacco and nicotine products – including electronic nicotine-delivery systems (ENDS) – to achieve parity with the traditional tobacco tax rate.

The proposed rule aims for the tax per 1,000 cigarettes to be increased to $100.66. Vaping products would be taxed at this same rate, with 1,000 cigarettes being equal to 1,810 milligrams of nicotine.

“In addition to the one-time increase, the rates would be indexed to inflation, which means they would automatically increase every year,” the report states. “According to Tax Foundation estimates, the tax increases would raise $112 billion over 10 years. The bulk of the revenue, $74.8 billion, is from the doubling of cigarette taxes. The tax on vapor products would raise roughly $15 billion over 10 years.”

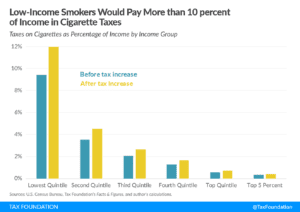

According to Alex Norcia of Filter, the proposal would benefit large corporations and traditional tobacco products, while unfairly hurting people in lower socioeconomic classes as most smokers do not typically belong to the upper classes. Current cigarette smoking in the United States “is higher among people with low annual household income than those with higher annual household incomes,” according to the Centers for Disease Control and Prevention.

“This means that a 30-milliliter bottle of e-liquid containing 3 milligrams of nicotine per milliliter would be subject a tax rate of $5 for the bottle. A 120-milliliter bottle of e-liquid that contains 6 milligrams of nicotine per milliliter would attract a tax rate of $40 for the bottle,” writes Norcia. “In comparison, critics and tax reformists have estimated that a four-pack of Juul pods would be taxed around $9—giving a clear advantage to a giant over the smaller player. More alarmingly, a pack of cigarettes would only be taxed around $2, creating an incentive for nicotine users to pick cigarettes over less-risky vapor products.”

The TTE Act as part a massive $3.5 trillion spending bill appear to be heading for a collision with President Joe Biden’s pledge not to raise taxes on America’s middle class. In an interview with C-Span on Sept. 15, White House Press Secretary Jen Psaki was asked if the White House believes that the proposed bill on taxing tobacco/vaping products would violate Biden’s promise to not raise taxes on those making under $400,000 per year. She replied, “No, we don’t,” adding that it was “just one of the ideas out there.”

Vape Shop owners are saying that the proposed tax increase would “completely destroy” their businesses, saying it would be even worse than the U.S. Food and Drug Administration’s failure to approve any ENDS products by the Sept. 9 deadline and the issuing of nearly 200 marketing denial orders (MDOs).

“This is going to more than double, and in some cases triple or quadruple, the price of liquids that I sell,” says Keith Gossett, the owner of Bucky’s Vape Shop in Columbus, Georgia, told Reason. “I’m going to sit there and try to tell a man with a $6 pack of cigarettes that my [$75] product is better. This tax will close my shop.”

The last time the federal excise tax on tobacco was increased was in 2009. While the federal tax has not changed for 12 years, the average tax paid by consumers has increased drastically. Including the last federal increase, the average combined state and federal excise tax rate on tobacco products has jumped more than 80 percent (the average state excise tax rate increased 65 percent between 2009 and 2021), according to Tax Foundation.