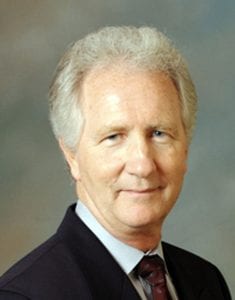

Participants heard from scientists, retailers, legal experts and CTP Director Mitch Zeller.

Scientists, data analysts and legal experts shared their insights into the rapidly changing U.S. nicotine business on Nov. 17, the first day of TMA’s “From Chance to Change” webinar. Participants also heard from retailers and the industry regulator.

Mitch Zeller, director of the Food and Drug Administration’s Center for Tobacco Products, reviewed the latest data on youth e-cigarette consumption, which he said continues to be concerning. However, Zeller was quick to point out that because the 2021 study was the first to be conducted completely during the Covid-19 pandemic, the data could not be compared to that of the previous year.

Zeller also provided an unprecedented behind-the-scenes peek into the center as it processed millions of premarket tobacco product applications. The agency received applications covering more than 6.5 million deemed products, and most of them were submitted close to the Sept. 9, 2021, deadline—a date that, Zeller reminded his audience, had been brought forward by a full year following litigation by public health groups.

Because companies were not required to submit their applications in a particular way, the agency had to be ready to process for a wide variety of formats. “We had to prepare operationally, technically and logistically to ‘ingest’ all those applications,” said Zeller, adding that the agency was thrilled its submission system did not collapse under the volume of last-minute applications.

The FDA has by now acted on the vast majority of applications, sending refuse-to-file letters, issuing marketing denial orders (MDOs) or, in a handful of cases, granting marketing orders. “We are down to 80,000 products—most of them in the final stages of review,” said Zeller. Those still-pending applications, he acknowledged, include ones submitted by the companies with the largest market shares because they tend to be the largest and most complex applications.

Zeller also commented on the rising popularity of synthetic nicotine, which some MDO recipients, including market-leading Puff Bar, have embraced as a tool to keep their products on the market because they believe it is outside of the regulator’s remit. The FDA defines a “tobacco product” as anything “made or derived from tobacco that is intended for human consumption, including any component, part or accessory of a tobacco product.”

Synthetic nicotine, said Zeller, presents a new challenge for the regulator, in part because it is increasingly difficult to distinguish the compound from its naturally derived counterpart. Nicotine, he explained, comprises two isomers: R and S. Tobacco-derived nicotine is 99 percent S, and early synthetic nicotine had a 50-50 split between R isomers and S isomers. However, newer versions of synthetic nicotine have much higher proportions of S isomers, making it harder to tell them apart from natural nicotine.

The first panel discussion of TMA’s online seminar, moderated by Jim Solyst, principal of JMS Scientific Engagement, debated the status quo from an applicant’s perspective. The panelists included Brittani Cushman, senior vice president, general counsel and secretary at Turning Point Brands; Beth Oliva, partner at Fox Rothschild; Brian Erkkila, director of regulatory science at Swedish Match; and John Pritchard, vice president of regulatory science at 22nd Century Group.

While all participants expressed appreciation for the FDA’s daunting workload, some voiced disappointment with the fact that many applications appear to have received only a perfunctory “fatal flaw” review—a review in which the agency, rather than reviewing a submission on its merits, simply looks for the presence or absence of certain studies. The panelists lamented that the pathway to market is more cumbersome for reduced-risk products than it is for deadly combustible products.

Participants worried also about how the public would interpret the lack of determinations on major applications, citing persistent misunderstanding of reduced-risk products and the continuum of risk by legislators, journalists and even physicians.

Asked to look forward, one panelist suggested the industry should consider what it would do when the next e-cigarette or vaping use-associated lung injury (EVALI) happens, referring to a mysterious outbreak of lung injuries in 2019 that was caused by illicit THC products but tainted the entire industry. Another participant stressed the importance of enforcement after all marketing applications have been decided. If any “yahoo” can sell products without authorization, she said, it would render the investments by the good actors worthless.

The second panel of the TMA webinar, moderated by Mary Szarmach, senior vice president of governmental and external affairs at Smoker Friendly, reviewed the market from a retailers’ perspective. The panelists included Don Burke, senior vice president of Management Science Associates; Tom Briant, executive director and legal counsel at the National Association of Tobacco Outlets; and Amanda Wheeler, president of the American Vapor Manufacturers Association.

Burke sketched the latest trends in the nicotine market. The pandemic, he said, makes comparisons with 2020 difficult. With many people working from home last year, sales of cigarettes and large cigars experienced unusual growth, but as people returned to the office in 2021, those trends are starting to level off or are even reversing. Burke expects cigarettes to resume more normal consumption patterns next year. Modern oral continues its remarkable growth, albeit at a lower pace than last year because most convenience stores are by now carrying the product. And volume sales of vapor cartridges are up by more than 18 percent as the EVALI crisis fades from memory.

Briant provided a regulatory update, touching on the proposed nicotine tax hike in the Biden administration’s Build Back Better legislation, the FDA’s proposal to ban menthol in cigarettes and flavors in cigars and the status of graphic health warnings, which are currently being challenged in court. Litigation has pushed the implementation date to January 2023, and this could be further extended. Briant noted that there have been no hearings yet on the merits of graphic health warnings.

Asked to analyze vapor retailers’ current predicament, Wheeler drew an analogy with the Hindenburg disaster, after which shattered public confidence marked the abrupt end of the airship era. She cited the avalanche of MDOs, the U.S. Postal Service ban on shipping vapor products and the proposed federal excise tax on vapor products, which would make vapor products more expensive than some cigarettes.

Wheeler said these developments were driving vapers back to cigarettes, illicit producst and synthetics—many of them made abroad and falsely labeled. She described a “misguided crusade,” funded by deep-pocketed donors and cheered on by the irresponsible media. “When smoking was plummeting, they took action to make it increase; when American entrepreneurs innovated a news sector, they strangled it,” she said.

Asked what kept them up at night, the panelists named employee safety, flavor bans and lack of enforcement.

Szarmach related how a tax increase in Colorado had instantly resulted in more break-ins and robberies at her stores—an unwelcome development at a time when workers were already in short supply. Briant said that local flavor bans drove customers away without affecting total consumption—consumers would simply buy their products elsewhere. Wheeler said Arizona was not enforcing Tobacco-21 legislations, enabling bad actors to do good business.

The TMA online seminar continues today at 10:30 a.m. Eastern Time with a keynote from CTP Office of Science Director Matt Holman and panel discussions on “Your path to market” and global trends.

To register, please click here. Registrants will also have access to previously aired sessions.