Analysts Supporting Turning Point Brands’ Stock Upside

- Financial News This Week

- October 26, 2020

- 3 minutes read

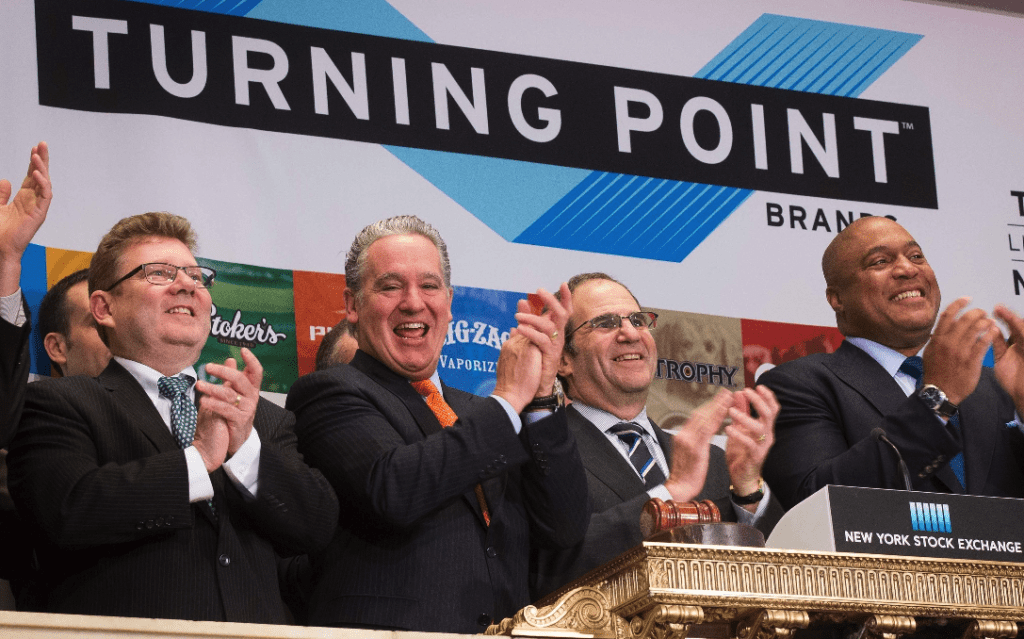

Financial analysts are now falling in love with Turning Point Brands (TPB). The company’s stock, TPB, now has at least three analysts covering the stock and the consensus rating is “Buy.” The company has submitted premarket tobacco product applications (PMTA) for 250 products.

The target price ranges between 50 and 39 calculating the mean target price of 42.67, according to data from seekingalpha.com. TPB’s share price reflects a potential upside of approximately 30 percent based on the underlying business with additional “upside optionality” from each of the opportunities noted above.

Reasons for the growth include recent U.S. Food and Drug Administration (FDA) regulatory intervention that “creates multiple market share ‘land grab’ opportunities for TPB as non-compliant competitors are forced to exit the marketplace. There are also new growth initiatives for the smokable CBD segment through product introductions (e.g., cones, hemp paper) and entry into alternative growth channels (e.g., headshops, dispensaries and e-commerce) in both US and Canadian markets,” according to seekingalpha.

“The NewGen division represents TPB’s growth engine and platform focusing on developing, testing, acquiring and investing in high-growth new proprietary businesses,” writes the author. ” While it is the largest revenue segment, it currently includes mostly lower margin third-party products sold through online distribution channels. As the product mix shifts towards proprietary products, the gross margins will rise to proprietary standard margins of 50%+ without impacting costs.”