Bans on flavors in vapor and heated tobacco are likely to spread.

By Barnaby Page

Flavors are perhaps the biggest battleground of all in e-cigarette regulation—much more so than nicotine strength, for example. That may seem surprising on the surface given the widespread misperceptions of risk associated with nicotine itself (as opposed to smoking), but the underlying reason is revealing. Although occasionally there are other rationales associated with flavor bans (specific harmful ingredients, or a racial dimension in the case of menthol in the United States), nearly always the argument against flavors is a proxy for anxieties over youth vaping.

To put it another way, if nobody thought that anyone other than adults would use mermaid-flavored caramel candy floss e-liquid, nobody would be very interested in banning it (and in fact, adult usage of these flavors is almost completely overlooked in the debate). It’s because kids use—or, more precisely, are perceived to be attracted by—these flavors that regulators, politicians, pundits and pressure groups pay so much attention to them.

Underage vaping undoubtedly occurs; this is indisputable. Whether flavors (which in regulatory terms means nontobacco flavors) are in fact a significant driver of this is more debatable. It’s true that young people often use the more exotic flavors, but that doesn’t mean the nicotine users among them wouldn’t vape if those flavors weren’t available.

Of course, those who are vaping nicotine-free flavored liquids presumably wouldn’t find nicotine-free tobacco-flavored liquid very appealing, and they probably wouldn’t vape at all if their favored flavors were unavailable. But these nicotine-free users are not the main concern.

Similarly, it’s true that kids say they like the flavors they use. But this is hardly unexpected; nobody would use a flavor they don’t like. Again, it doesn’t conclusively point to what would happen in the absence of flavors, and this is an area where more research is needed—research that will become more viable on a large scale as more and more flavor bans are implemented.

The results may prove to be unexpected: for example, work by Abigail Friedman at Yale suggests that the San Francisco flavor ban may have pushed young people not toward tobacco-flavored vapes but toward combustibles, and while one research project in one city is of course not the end of the story, it underlines the importance of looking at the real consequences of regulation in this area. If flavor bans do not keep kids away from nicotine, there is little purpose to them.

For now, though, limiting flavors is rightly or wrongly seen as key to limiting youth vaping, and prohibitions are spreading worldwide—perhaps not as quickly as the heat of the conversation might suggest but steadily nonetheless.

The United States is in an unusual situation here, partly because of the considerable autonomy enjoyed by sub-national levels of government compared with many other countries and partly because of slow movement by the Food and Drug Administration. There can be almost no doubt that the FDA would like to ban flavors; after all, it has even backed the idea of a menthol ban in combustibles, which is far more contentious than any restrictions on e-cigarette flavors, and seems likely to be preparing to finalize a rule to that effect this fall.

Where vapor is concerned, there is no formal prohibition as such (though it is always conceivable that the anticipated combustibles ban could in fact cover all tobacco products), but a de facto ban on vapor flavors seems to have been in operation via the premarket tobacco product application (PMTA) process. To put it bluntly, flavored products don’t get through, and indeed this has been formally alleged by R.J. Reynolds Vapor Co. in a case against the FDA, as yet unresolved.

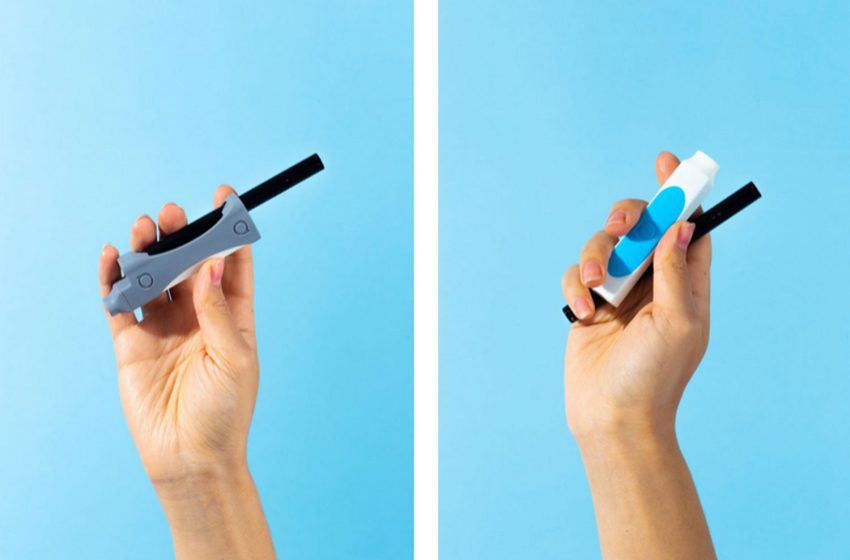

In this context, it might seem odd that the FDA did grant modified-risk tobacco product (MRTP) status to menthol-flavored IQOS products from Philip Morris back in 2020—MRTP of course being an overt acknowledgment of reduced risk, not merely an authorization to sell like the PMTA. This might reflect the fact that youth usage is much less associated with heated-tobacco products like IQOS than with vapor; in fact, heated tobacco was barely known in the U.S. in 2020, has worldwide generally given rise to much less anxiety over underage use and is generally not found in the more unusual, supposedly youth-friendly flavors. Or it might simply be an anomaly. Either way, the IQOS decision seems unlikely to be any kind of precedent for a softening of FDA attitudes toward flavored vapor.

In the absence of an official FDA rule, formal regulatory activity against flavored vape products in the United States has most significantly occurred at state level—for example, with bans in California, New Jersey, New York and Rhode Island, an almost complete prohibition in Massachusetts and heavy restrictions in Maryland and Utah. Some other states also instituted emergency bans in 2019 that have now ended. There has also been much activity at county and municipal level (most notably in California and Massachusetts and to a lesser extent in Minnesota).

Elsewhere in the world, again partly reflecting the allocation of powers to national and sub-national governments, there are countrywide bans.

Among those nations that allow e-cigarettes as a product category but ban flavors, China is potentially the most important given its sheer size. However, the Netherlands—a country where skepticism over vapor in official circles is high—has also received much attention, not least because it could pave the way for other European countries to follow suit. Finland has already passed a bill prohibiting flavors in all inhalable products, and we believe Norway is also likely to enact a vapor flavor ban; Belgium is another possibility, though one we consider less likely.

Much of the forecasting in this article is drawn from the Tamarind Intelligence Policy Radar, which presents the regulatory situation in more than 50 markets for alternative tobacco products as it is today and as it is projected to be in five years. It monitors more than 150 bills and policies, many of which seek to substantially increase the regulatory burden on novel tobacco and nicotine products. Based on this, other countries where we see a vapor flavor ban as possible include Canada and Argentina, although the latter is a less likely contender.

Other countries have taken steps toward banning flavors in all alternative products. Nations such as Spain, Belgium, Russia and the Czech Republic have raised concerns about flavors in new tobacco and nicotine products in their policies, which include, for example, national tobacco plans and health strategies. However, it should be noted that we forecast some of these first steps toward a flavor ban to have a low likelihood to medium likelihood of adoption. This may be because the measure has not been a pressing issue for a government faced with elections in the near future, as with Spain, or because the policy has remained stuck in the legislative process for years, as is the case with the bill in Belgium.

Comprehensive bans like these could be expected to also cover heated tobacco. Some countries, however, may choose to treat it separately; among these, we think a ban is likely in Taiwan and possible in the United States.

In terms of sheer number of countries, however, by far the most important limitation on heated-tobacco flavors is the European Union ban, which entered into force late last year via a European Commission directive.

Such directives do not have automatic legal power in all 27 EU member states, but the individual countries are obliged to incorporate them into domestic law, a process known as “transposition,” which must in this case be completed by October (and which also applies to the European Economic Area members Norway, Iceland and Liechtenstein). When this is complete (and though the deadline could be missed in some cases, it will almost certainly be completed), heated-tobacco flavors will be banned across most of Europe, leaving the post-Brexit United Kingdom—the most friendly of all European nations toward reduced-risk nicotine products—as the major outlier where flavors are still permitted.

In this context, the ongoing revision of the EU Tobacco Products Directive (TPD) itself is also noteworthy. It was the 2014 version of the TPD that laid the groundwork for the e-cigarette regulatory frameworks in all EU member states (at that point including the U.K.), for example with limitations on nicotine strength, and with the next incarnation of the directive currently being drawn up, there is at the very least a possibility that it could include a flavor ban for alternative products, including vapor.

If that happens, it might well be enough to sway undecided countries outside the EU and persuade them to enact their own flavor bans—perhaps even the U.K. It is also possible that, amid environmental concerns about the sudden rise of disposables, “flavor” will become a proxy for “disposable” in exactly the same way it has been for “underage.”

At the same time, it is always conceivable that some yet unknown nicotine-delivery technology might escape these prohibitions if there are no concerns about youth usage.

But it is unlikely that bans that do come into force will be reversed, regardless of their outcomes; perception is often as important as reality in regulating this area. Though it hasn’t happened yet, the alternative nicotine products sector may be facing a flavorless future.

Barnaby Page is the editorial director of Tamarind Intelligence, the publisher of ECigIntelligence, TobaccoIntelligence and CannIntelligence. As a journalist, he has been covering the worldwide reduced-risk nicotine sector since 2014, with a particular focus on public health and regulatory issues.In his current role, he manages Tamarind’s editorial and reporting teams, producing a wide range of nicotine-related content. He previously spent 30 years as a reporter and editor for newspapers, magazines and online services, specializing in technology and business. He is based near London, England.

Tamarind Intelligence analysts Berta Camps Bisbal and Sergi Riudalbas also contributed research to this article.