The China-based vaping technology manufacturer Smoore International announced its financial results for 2021. The company reported 2021 annual revenues of RMB13.75 billion ($2.16 billion), representing a year-on-year increase of approximately 37.4 percent.

The company credited it’s FEELM atomization company and its innovative vaping solutions for its growing success. “The driving force of the atomization industry is technological innovations, which brings fundamental breakthroughs in product safety and flavor reproduction”, said Smoore Board Chairman, Chen Zhiping.

In a press release sent to Vapor Voice, Smoore also pledged to achieve carbon neutrality in its direct and indirect production and operational activities by 2050. Smoore is the first atomization technology company to announce a roadmap to carbon neutrality.

“In 2021, the global regulations on the electronic atomization industry have become more stringent, and many countries set higher safety standards for electronic atomization products while Smoore has still maintained its position as the world’s largest manufacturer of vaping devices,” the release states.

According to Frost and Sullivan report, the Smoore’s market share in the global vaping devices manufacturing market has increased to approximately 22.8 percent in 2021 from approximately 18.9 percent in 2020.

With its technological advantages in atomization, Smoore has continued to empower its global corporate clients, according to the release. Revenue from corporate client oriented sales exceeded RMB10 billion and reached RMB12.59 billion for the first time in the company’s history. The increase represents growth of 37.4 percent year-on-year, with overseas revenue accounting for over 70 percent of its corporate client oriented sales.

“It is largely attributed to the company’s flagship closed system vaping tech brand FEELM, which has been widely recognized by leading vaping brands around the world,” the release states. “To date, vaping devices loaded with FEELM atomizer have been exported to 50 countries in Europe, America, East Asia, Africa, and Oceania, with its accumulated sales volume surpassing 3 billion pieces.”

Year in review

In 2021, SMOORE continued to strengthen its R&D investment. The total research and development expenses was approximately RMB670 million, representing an increase of approximately 59.7 percent over the previous year, according to Smoore.

The company has also developed a comprehensive safety assessment system to help its clients comply with standards in different markets. For example, Smoore created and put into action China’s first corporate one-stop risk assessment laboratory for the European Union’s Tobacco Products Directive compliance rules. The lab is capable of helping clients meet EU vaping market entry requirements, including having the ability to generate test reports within 5 working days.

Smoore has also put into operation seven fundamental research centers in China and the U.S. As of Dec. 31, 2021, Smoore had a total of 1254 R&D experts, with 101 having a doctoral degree or above, according to the release.

“The number of the company’s accumulative patent applications is 3408, involving temperature control, heating element, leakage-proof performance and e-liquid storage; and the number of new patent applications in 2021 was 1,187 globally,” the release states. “In 2021, Smoore also introduced the latest generation of production line, realizing the fully automated production of assembly, e-liquid injection, and packaging. Now, the single-line production efficiency has reached 7,200 standard vaporizers per hour, maintaining the industry’s leading position in manufacturing. The fully automated production line has been used by FEELM’s clients on a large scale.”

According to the Frost and Sullivan Report, the global market size of vaping devices is expected to grow at a compound growth rate of approximately 25.3 percent from 2022 to 2026, and global consumers are expecting products with improved safety, more authentic flavor reproduction and powerful functions, to satisfy their diversified needs.

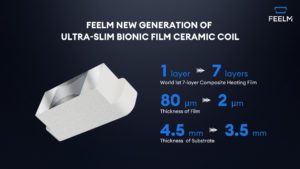

“This is why FEELM introduced the world’s first ceramic coil disposable pod solution in 2021. FEELM will launch more disposable vaping products in overseas markets in 2022 to further strengthen its product portfolio,” the release states. “Moreover, in January 2022, FEELM has showcased the world’s thinnest ceramic coil vape pod solution, FEELM Air in London.”

The FEELM Air features seven major breakthroughs in vaping experience, including harm reduction, flavor reproduction and leakage-proof performance. “FEELM Air is going to be firstly launched in overseas markets,” said Frank Han, president of FEELM and vice president of Smoore. “Currently, FEELM is working with global clients on the regional deployment and promotion of FEELM Air.”

During Smoore’s 2021 Annual Performance Conference, Qiu Lingyun, vice president of Smoore said that the U.S and China have successively implemented a flavor ban on e-cigarettes, and Smoore has already prepared technical solutions for tobacco flavors in accordance with the U.S regulations over the last year, prior to the exposure draft of Chinese national standards of e-cigarettes that comes into force on May 1.

“Moreover, disposable vapes have shown strong growth momentum in recent years,” said Qiu Lingyun. “Smoore has developed integrated solutions to the heating element, e-liquid and temperature zone of disposable vapes, in a bid to diversify its product portfolio. Thus, SMOORE has been ready to launch successful disposable products in international markets soon.”