Alibaba International Station announced that, beginning May 1, it will no longer allow the sale of vaping products. The cross-border trade B2B e-commerce platform’s ban will include cartridges, e-liquids, hardware and all other vaping related products.

In March this year, the State Tobacco Monopoly Administration of China announced the promulgation of the Measures for the Administration of Electronic Cigarettes, which also comes into force on May 1.

After the document was issued, many e-cigarette brands said that they will actively implement the regulatory requirements and stop the production of e-cigarettes with fruit flavors in the domestic market, according to dayday News. Therefore, under the new regulations, the prices of e-cigarettes have been rising. Many brands raised the price of their e-cigarettes with various fruit and soda flavors, with prices increasing between 20 yuan ($3.14) to 30 yuan ($4.71).

According to a report released by iiMedia Research, the retail sales of the global new tobacco market reached 360.5 billion yuan in 2021, an overall increase of 25.6 percent, while China’s domestic sales increased by 73 percent. In addition, according to the Blue Book of the Electronic Cigarette Industry in 2021, in terms of export, the total output value of electronic cigarettes exports reached 138.3 billion yuan, and there are more than 1,500 e-cigarette manufacturers in China.

A seven percent rise in full-year adjusted revenue to 25.7 billion pounds ($34.8 billion) was reported by

A seven percent rise in full-year adjusted revenue to 25.7 billion pounds ($34.8 billion) was reported by

The U.K. Vaping Industry Association (UKVIA) anticipates a busy year for the sector, the industry group noted at the publication of its

The U.K. Vaping Industry Association (UKVIA) anticipates a busy year for the sector, the industry group noted at the publication of its

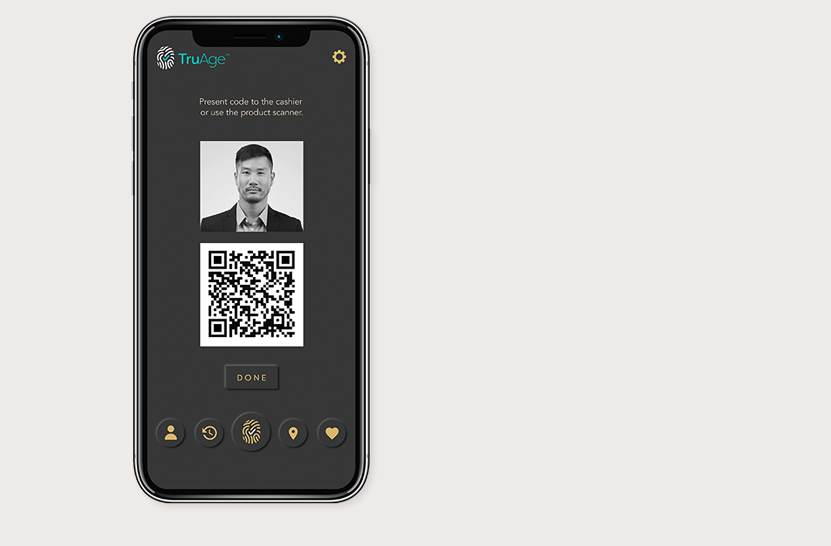

Altria Group Distribution Co. and Juul Labs have announced their support of TruAge, a new digital solution that enhances current age-verification systems and protects user privacy.

Altria Group Distribution Co. and Juul Labs have announced their support of TruAge, a new digital solution that enhances current age-verification systems and protects user privacy.