Greentank is at the forefront of innovation with the launch of its patented Heating Chip technology.

By Timothy S. Donahue

The vaping industry is in a constant state of innovation, primarily driven by advancements in hardware. A significant focus has been on enhancing battery quality as well as the electronics and circuitry within vaping systems. Notably, there have been substantial advancements in atomization technology. This includes the development from traditional wire coils and wicks to a more progressive adoption of ceramic materials.

Atomization technology is crucial because the heating element functions as the core of a vaping system. The coil’s role in atomizing e-liquid is pivotal; the more efficient the element, the better the aerosol production, consistency and flavor. Recently, a leading technology company announced its breakthrough in heating technology, set to revolutionize the market.

It has been seven years since a significant advance has been made in atomization technology. Enter Greentank: a company with a wholly new design representing a dramatic step-change from the conventional ceramic and wicked coil systems prevalent in many of today’s vaping products, promising enhanced safety, performance and experience.

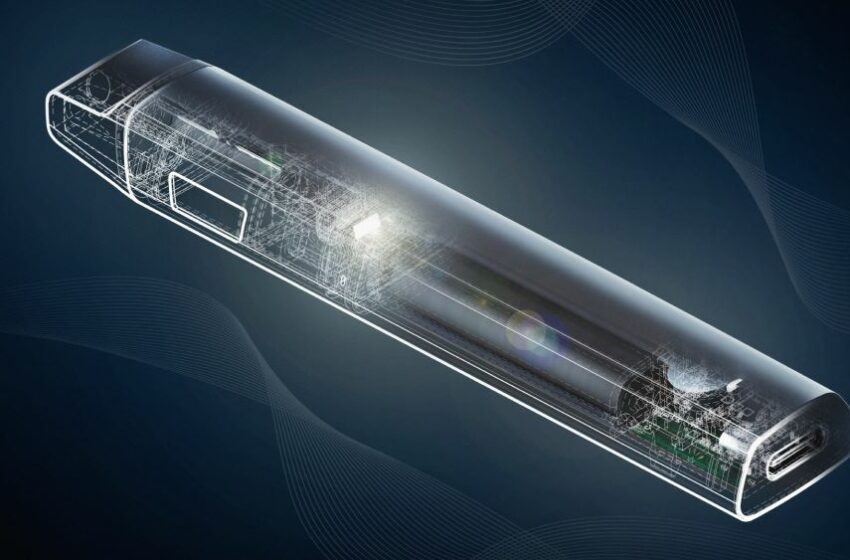

Greentank is a business-to-business technology company that specializes in the design, development and manufacturing of precision-made inhalation devices and atomization technology, according to CEO Dustin Koffler. Greentank’s latest innovation in atomization is called Quantum Vape. It replaces cotton wick and ceramic heating elements with a state-of-the-art patented Heating Chip.

According to Koffler, the Heating Chip outperforms all other leading atomization products. For example, the Heating Chip performs better on key safety metrics such as harmful and potentially harmful constituents (HPHCs) and heavy metal testing than other leading technologies in the market. It also produces the “absolute greatest” release of flavor and the most consistent consumer experience from the first draw to the last, he says.

“With this breakthrough in inhalation science, we’ve catapulted beyond the current generation of atomization technology,” said Koffler. “Our Heating Chip is set to disrupt the global market. It’s a distinct departure from anything currently available. While many companies focus merely on tweaking the substrates and print materials used in ceramic-based systems, they remain bound to the same ceramic foundation.

“They’re refining ceramics—making components slightly smaller, slightly tighter, experimenting with new materials and formulations. Greentank, however, is pioneering an entirely novel approach that’s unlike anything witnessed in the industry before.”

The Heating Chip is small. It comfortably fits on a fingertip and is one-fifth the size of today’s heating solutions. However, Koffler said its high-performance standards are due to advances that have never been achieved before with atomization. Typically, in a ceramic heating element, over time, flavor starts to dissipate naturally. This is because there is caking or buildup inside the pores of the ceramic, causing the temperature throughout the ceramic to vary after each use, leading to thermal cycling. With the Heating Chip, there is zero potential for thermal cycling, according to Greentank; every puff tastes the same as the first.

“The Heating Chip employs a unique capillary action to draw the oil through the heating element, ensuring that each puff initiates a fresh cycle of material,” explained Koffler. “Many products boast consistent flavor throughout use, yet we’re all aware that the current market offerings fall short in maintaining this throughout the life of the product. In contrast, the Heating Chip integrates nanofabrication into its design.

“The entire manufacturing process is proprietary, involving novel methods to assemble materials into the Heating Chip that emits no ceramic particle emissions and contains the lowest levels of harmful and potentially harmful constituents. While it’s not feasible to claim complete absence, third-party testing and rigorous chemical analysis have found these HPHCs to be at undetectable levels.”

Additionally, Greentank only recently completed a longevity study using the Heating Chip in one of the company’s proprietary electronic nicotine-delivery system devices with a target of 15,000 puffs. “We easily achieved this target while demonstrating consistent vapor output from the first puff to the 15,000th puff,” explained Koffler. “Furthermore, we provided these same devices, along with new ones, to Labstat International to conduct aerosol analysis for both carbonyls and metals. The results showed that there was no difference in the safety efficacy from the first puff to the 15,000th puff.”

Technically Speaking

To a scientist, it’s a micro channel-based aerosol generator that delivers sub-micron particles according to its proprietary design. To the average consumer, it’s a smoother experience with maximum flavor intensity in a less-risky delivery than currently marketed e-cigarette and cannabis vape products. The Heating Chip isn’t anything like ceramics, said Koffler. Porosity isn’t inconsistent. It’s a chip with thousands of small holes and microchannels that allow for a superior level of precision and control in the atomizing process.

One of the major challenges in designing the Heating Chip was finding the right talent to help develop the manufacturing process, said Koffler. The manufacturing of the Heating Chip requires specialized equipment, and bringing together a system that worked was incredibly complicated. The manufacturing of the Heating Chip can be compared to producing semiconductors.

“By adapting pioneering techniques from other advanced industries and tailoring them to meet our specific requirements, we’ve enhanced our technology’s performance,” Koffler revealed. “The expertise of our global team, the precision of the equipment we utilize and our methodical focus on perfecting one aspect of the process at a time has been instrumental in overcoming the challenges we faced.”

The next generation of atomization technology is moving away from ceramics, according to Koffler. The Heating Chip technology avoids all heavy metal leaching and ceramic particle emissions and ensures the lowest HPHCs all while permitting an unprecedented taste and consistency over a longer lifetime.

It also offers a smoother experience and better mouth dispersion. Interestingly, the device is also able to create particulate matter small enough to reach lower lung absorption levels for nicotine, much like combustible cigarettes. This could be a giant innovation in getting smokers to adapt to less risky nicotine-delivery systems.

“Utilizing microfluidic channel technology, we’ve engineered a system that precisely controls aerosol nucleation and optimizes particle size, enriching the sensory experience while maximizing intensity without any harshness,” Koffler detailed. “Our design includes independently arranged channels and a thin film interface that safeguards against chemical reactions and thermal decomposition. This architecture not only enhances flavor fidelity and ensures consistent temperature but also elevates safety standards and reduces potential harm significantly. From the outset, our goal was to achieve unparalleled performance and safety.”

The size of the Heating Chip is incredible. It’s tiny. It’s one-fifth the size and 100 times the precision of any ceramic atomizer on the market today, according to Koffler. Its reduced size creates greater design flexibility and quicker response times. The Heating Chip is produced on sophisticated micro- electromechanical systems (MEMS) machinery. MEMS is a general term for forming a micron-level three-dimensional structure on a support substrate such as a silicon wafer and integrating functions such as electronic circuits, sensors and actuators.

“Unlike the broad, imprecise methods typical of ceramic manufacturing, our approach from start to finish is meticulously controlled and exact,” explained Koffler. “This precision is why developing the right equipment for producing the Heating Chip was an extensive process. The level of control we achieve with the MEMS technology not only enhances consistency but also opens up revolutionary possibilities in precise dosing for pharmaceutical applications. This capability to finely tune dosages is a game changer in both vaping and medical fields.”

Future Markets

Based in Toronto, Canada, Greentank doesn’t produce nicotine. It doesn’t manufacture e-liquids or cannabis products. At its core, Greentank is a technology and product development company with a focus on safety, performance and reliability. The Heating Chip is not made from ceramics. While the material is proprietary, Koffler insists the technology is something new and its application in inhalation products is only scratching the surface of its potential. It is designed specifically for multiple verticals, predominantly electronic nicotine-delivery systems but also pharmaceuticals and wellness products.

“We have expanded to over 100 employees across Canada, the U.S., the U.K., Singapore and China, with the majority focused on research and development,” Koffler detailed. “We’ve assembled a highly skilled manufacturing team to produce our innovative chip and have strengthened our engineering and material science capabilities. Last summer, we acquired Numerical Design, a company specializing in microfluidics and microfabrication, boasting an extensive portfolio of patents that further strengthen our intellectual property. This strategic expansion underscores our commitment to leading the edge in technology and manufacturing excellence.”

Greentank spent over three years developing and testing the technology surrounding the Heating Chip and its manufacturing process. Additionally, it has been created with a robust intellectual property portfolio involving more than 50 patent families to bring forward a variety of advancements. The company’s technology is manufactured in ISO-certified labs, and all products undergo third-party testing.

The technology is completely different from what exists in today’s inhalation devices. It gives Greentank the flexibility to be adopted into various inputs and varying viscosities. For example, it works well with both low-viscosity water-based e-liquids and high-viscosity resin oils from cannabis materials.

In March of 2023, Greentank announced that it successfully closed a $16.5 million Series B financing round led by a strategic investor group with more than 15 years of manufacturing experience. The total investment in Greentank to date is now reported at $38.5 million.

“Our Series B funding was a strategic move to elevate our operations from industrial prowess to global commercialization,” said Koffler. “We’ve established a 20,000-square-foot cutting-edge R&D and manufacturing facility, a project that spanned 18 months to build and equip with the most advanced technology needed to scale our Heating Chip.

“This facility not only pushes the limits of what’s possible with specialized equipment and expertise but is also designed with flexibility in mind. Our vision was to create a model that can be replicated anywhere in the world, preparing us to expand into any other market as we continue to grow our business.”

The expansion of the business is about phases, and Koffler said that during the next phase, whether that be the medical or wellness industry, Greentank needs to be able to produce chips to meet global demand with scale in mind. Koffler said this means that the company will look to leverage automation.

Koffler emphasized that the real measure of Greentank’s success will be seen as the next generation of inhalation devices hits the market. He highlighted that numerous devices are on the cusp of being launched, with the Heating Chip poised to redefine industry benchmarks for safety and efficiency. Currently, Greentank is aiming to influence tobacco harm reduction significantly.

“At Greentank, our commitment extends beyond mere compliance with regulatory standards; we are dedicated to establishing new paradigms of transparency and consumer safety,” said Koffler. “We are not just participating in the market—we are leading it toward a safer and better future.”