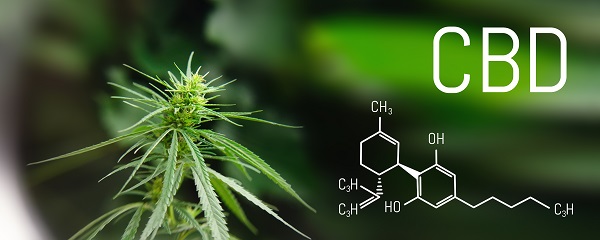

There are several different pieces that contribute to the production and quality of cannabidiol.

By Timothy S. Donahue

It’s in full bloom. The cannabidiol (CBD) market is growing fast in the U.S. Ever since the passing of the Agriculture Improvement Act of 2018—the law that changed federal policy regarding industrial hemp, including the removal of hemp from the Controlled Substances Act and the consideration of hemp as an agricultural product—the CBD market has blossomed. Today, CBD products can be found in nearly every type of retail store from Walgreens and Sephora to brick-and-mortar vape shops.

The Brightfield Group, a CBD and cannabis industry analytics firm, expects large companies to continue to publicly enter the CBD market (Ulta Beauty, Neiman Marcus, Barney’s and DSW have all entered the CBD market) in 2019. The potential market growth for CBD is staggering. During a seminar centered on the CBD industry during the Tobacco Plus Expo (TPE), which was held in Las Vegas from Feb. 11–13, Christian Cypher, the senior vice president of Global Specialty Products and managing director of Specialty Crops for Pyxus International, the parent company of Criticality, an industrial hemp company based in North Carolina, USA, said that the hemp/CBD market could grow to $22 billion by 2022.

The Brightfield Group estimates that CBD beauty products alone will hit nearly $290 million in 2019. This doesn’t account for large segments in the food, beverage and pet industries, according to an article by Connor Skelly on The Brightfield Group’s website. “Due to the wide range of CBD companies that are in the marketplace today, it is paramount that retailers be attentive to the legitimacy, product quality and safety offered by any CBD brands they intend to partner with,” Connor writes. “Additionally, retailers should align themselves with CBD companies whose positioning and messaging fit with those of their core consumers, which requires a deep understanding of the CBD marketplace—from a regulatory and market perspective all the way down to an understanding of the end consumer.”

Former U.S. Food and Drug Administration (FDA) Commissioner Scott Gottlieb, who resigned on April 5, told lawmakers that he was uneasy about the recent decision by Walgreens and CVS to start selling CBD products in their stores. Gottlieb had also previously tweeted about his “concern” without directly mentioning the companies before doing so during a speech. “We expressed concern … about Walgreens and CVS stepping into this market. So you now see big-box stores seeking to market CBD products for some uses where the claims seem to be potentially over the line, for the treatment of pain, for example,” Gottlieb said during a House Appropriations Committee hearing.

Hemp is federally classified as cannabis that contains less than 0.3 percent tetrahydrocannabinol (THC), the psychoactive ingredient found in cannabis. CBD is a phytocannabinoid that was discovered in 1940. It is just one of over 113 identified cannabinoids in the cannabis plant. Several studies have been or currently are being conducted that center on CBD’s impact on anxiety, cognition, movement disorders and pain. An increasing body of scientific research encompasses more than 60 ways CBD affects humans. However, as far as the general public is concerned, CBD production is still largely misunderstood.

PROPER PRODUCTION

There are generally three types of CBD. The contents of the refined extract are what determines if the CBD extract is classified as full spectrum, broad spectrum or CBD isolate. Full-spectrum CBD or hemp oil generally refers to products that contain CBD and the other plant molecules found in hemp, according to Cypher. “Full-spectrum CBD oil leaves most of the cannabinoids and terpenes intact,” he says. Many experts say that full-spectrum CBD products have the advantage of containing many different cannabinoids and terpenes as well as the potential for a broader health impact.

CBD Isolate is on the other end of the spectrum for CBD products. CBD isolate is generally labeled as being 99 percent or higher purity depending on the product, according to Mike Schriefer, CEO of Custom Brand Distribution (CBD2), a South Carolina, USA-based CBD manufacturer of multiple brands, including RMDY.

“As the name suggests, these products have been isolated down to just the CBD molecule,” he says. “Isolates can be more expensive than full-spectrum CBD. Isolates undergo more extensive refinement and need greater volumes of plant matter in order to get high levels of isolated CBD.” All THC is removed from CBD isolates. There is currently some scrutiny surrounding isolates and patent rights, and they could be pulled from the general market.

Broad-spectrum CBD is a sort of mix between full-spectrum CBD and CBD isolate. Like full-spectrum CBD, the other compounds found within the plant are preserved in the broad-spectrum extract; however, like the isolate, all the THC is removed. Differing from isolates, broad-spectrum CBD offers all the benefits of the hemp plant without any THC.

Depending on the strain and the method used for extraction, the composition and CBD profiles are different. The better the hemp, the better the CBD it will produce. There are several factors that pertain to quality CBD production. The first and most basic of those factors is seeds. One of the keys to achieving healthy hemp plants is starting with high-quality seeds, according to Schriefer. “Of course, quality soil, adequate watering and good light contribute to final yields too, but starting with quality genetics in your seeds is equally important,” he says.

Another important factor in producing a high-quality CBD is the location in which the hemp is grown. Where the biomass for CBD is farmed is crucial to the quality of the final product. Cypher says that industrial hemp could be referred to as nature’s vacuum cleaner. “One common myth is that hemp can be grown anywhere. Hemp grows best on well-drained soil,” he says. “You plant it and it’s going to take what’s in the soil and absorb it into the plant matter. The soil is very important.”

How the hemp is cured is also vital to producing high-quality CBD. The presence of any molds and/or mildew will lower the quality and value of hemp biomass, so a timely harvest is essential, according to George Place, county extension director for the North Carolina Cooperative Extension in Catawba County. Pace says that the curing facility should be under roof, out of direct sunlight and well-ventilated.

“Significant ventilation is crucial. Ideal temperatures for drying and curing are 60 degrees F to 70 degrees F at 60 percent humidity. A slow drying with high airflow will cure the hemp, produce a higher quality product (better cannabinoid and terpene spectrum),” says Place. “Hanging entire plants upside down on wires in the drying barn is a common practice. Unfortunately, as those plants dry, the branches droop down in the formation of a closing umbrella that … results in less air flow to the center of that entire hemp plant. Thus, more mold and mildew will grow in that center portion.” Pace recommends that farmers hang individual branches as opposed to the whole plant.

Next is how the CBD oil is extracted from the raw hemp. There are two types of preferred processing methods for CBD: ethanol and supercritical carbon dioxide (CO2) extraction. Making CBD oil with neurotoxic solvents like butane and hexane may leave unsafe residues and isn’t recommended, according to industry insiders. There is plenty of debate over which process is better, but, generally, both ethanol and CO2 can produce high-quality CBD.

The most common method is ethanol. It is less expensive than CO2 and easier to produce mass volumes. The solvent is passed over the plant material in order to dissolve the active compounds in the plant. The extraction liquid will strip away the cannabinoids and flavor from the plant material, according to Schriefer. The liquid is then heated to evaporate it down to the CBD base oil. “To isolate the individual compounds (CBD being one of them), the extracted oil needs to be distilled after extraction,” he says, adding that, if done properly, ethanol extraction can eliminate the need for a dewax or winterization.

Schriefer says that the supercritical CO2 extraction process is preferred by CBD2, even though it’s more expensive. He said the primary reason he prefers CO2 is that it creates a pure, clean, quality oil that is safe to produce with little to no post-processing required. “There is nothing wrong with using ethanol, but that process may require a number of hours to purge the solvent trapped in the oil,” Schriefer says, adding that CO2 is extremely versatile for creating a multitude of end products by controlling temperature and pressure. “These changes in the CO2 create an environment that allows for differing weights of components in the plant material to drop out.”

Refinement is what produces high concentrations of CBD. Extraction and refinement are two different processes. Refinement is used to further “clean” CBD after extraction. One process is called winterization, and it involves putting the raw cannabis extract through an alcohol wash that filters out some of the unwanted materials. The raw extract is immersed in the alcohol, where it is then frozen (hence the term “winterization”). Distilling is another process. A distilled CBD can produce oils with a very high potency. This is because the boiling point of CBD is very high. The CBD oil is heated, and much of the remaining plant matter is boiled away.

Then comes the testing. Manufacturers need to know what’s in their product. Benji Baker, a partner in Clearwater Biotech, a CBD/hemp testing facility, has nearly two decades of experience in hemp and cannabis testing. Interestingly, he also won ninth place in the Cannabis Cup in Vancouver, British Columbia, Canada, in 2002 out of 1,100 entries. He says there is currently very little professionalism and consistency in the CBD industry.

“Where the bottleneck occurs is when you pull CBD out of the oil you are concentrating down, and those numbers could multiply tenfold. THC measured at 0.3 percent in the field could be 30 percent after extraction. Now that oil isn’t compliant, things must be done, whether dilution or distillation,” says Baker. “To the end user, purity and quality are compromised. You can dilute it out, but then that impacts the quality and levels of those items in the CBD that you want. Testing helps formulations become much more precise; we know exactly how much CBD we have in our liquids.”

LEGAL LANGUAGE

It is true that CBD is legal at the federal level in all 50 U.S. states. The laws from state to state, however, can change. In most states, CBD must be derived from hemp, not marijuana. In some states, even an isolated CBD from marijuana is considered a byproduct of marijuana and illegal. There are currently eight states where the cannabis plant is completely legal for both recreational and medicinal use. These states are Alaska, California, Colorado, Maine, Massachusetts, Nevada, Oregon and Washington.

The U.S. Congress explicitly preserved the FDA’s authority to regulate products containing cannabis or cannabis-derived compounds under the Federal Food, Drug and Cosmetic Act (FD&C Act) and Section 351 of the Public Health Service Act. The New York City Department of Health recently banned the sale of food or drinks infused with CBD unless they are approved by the FDA.

It’s unlawful under the FD&C Act to introduce any foods containing added CBD or THC into interstate commerce, according to the FDA. This means all CBD edibles are illegal at the federal level. A company also cannot market CBD or THC products as dietary supplements, regardless of whether the substances are hemp-derived.

“This allows the FDA to continue enforcing the law to protect patients and the public while also providing potential regulatory pathways for products containing cannabis and cannabis-derived compounds,” according to an FDA release. “The FDA requires a cannabis product (hemp-derived or otherwise) that is marketed with a claim of therapeutic benefit, or with any other disease claim, to be approved by the FDA for its intended use before it may be introduced into interstate commerce.”

The FDA states that this is because both CBD and THC are active ingredients in FDA-approved drugs and were the subject of substantial clinical investigations before they were marketed as foods or dietary supplements. “This is a requirement that we apply across the board to food products that contain substances that are active ingredients in any drug,” the FDA has stated.

Only one CBD-infused medication, GW Pharmaceutical’s epilepsy treatment Epidiolex, has been approved by the FDA. “So even if there wasn’t an approved drug, because it was never previously in the food supply, we don’t have a clear route to allow [CBD-enhanced food products] to be lawfully marketed short of promulgating new regulations,” Gottlieb said.

Brian Moyer, CEO of Criticality, also speaking at the TPE, said one of the major challenges in the CBD market is the lack of regulations. He says he would like to see sensible guidelines, but those may still be a few years away. “Ultimately, it rests on the manufacturer to implement their own [quality-control] system,” he says. “We welcome intelligent regulation.”

On April 2, Gottlieb released a statement announcing new steps to consider the agency’s potential regulatory pathways for cannabis-containing and cannabis-derived products. “There are also unresolved questions regarding the cumulative exposure to CBD if people access it across a broad range of consumer products, as well as questions regarding the intended functionality of CBD in such products,” Gottlieb said in a statement. “Additionally, there are open questions about whether some threshold level of CBD could be allowed in foods without undermining the drug approval process or diminishing commercial incentives for a further clinical study of the relevant drug substance.

The FDA’s new steps include holding a public hearing on May 31, as well as a broader opportunity for written public comment. This is where stakeholders can share their experiences and challenges with CBD products. The FDA also intends to form a “high-level internal agency” tasked with exploring potential pathways for dietary supplements and/or conventional foods containing CBD to be lawfully marketed. It’s only a matter of time.

Patrick Basham, founding director of the Democracy Institute, a politically independent think tank, said that when the Canadian government legalized medical marijuana in 2001 and legalized recreational use in 2018, the marijuana industry began to see a change in the types of businesses getting into the fast-growing segment. Speaking at TABEXPO, a vapor and tobacco trade show that was held in Amsterdam in November, Basham gave an overview of the marijuana market, detailing the entrance of major tobacco companies into the rapidly growing cannabis industry. Basham has been involved in the legal cannabis industry for more than 22 years.

Patrick Basham, founding director of the Democracy Institute, a politically independent think tank, said that when the Canadian government legalized medical marijuana in 2001 and legalized recreational use in 2018, the marijuana industry began to see a change in the types of businesses getting into the fast-growing segment. Speaking at TABEXPO, a vapor and tobacco trade show that was held in Amsterdam in November, Basham gave an overview of the marijuana market, detailing the entrance of major tobacco companies into the rapidly growing cannabis industry. Basham has been involved in the legal cannabis industry for more than 22 years.