There’s a new synthetic product that some brands are using to replace nicotine in flavored vapes.

By Timothy S. Donahue

This story is based on a chemical reaction. When 6-methyl nicotine products hit the market last year, no one gave them much attention. After all, flavored nicotine products are readily available in most markets. This may not always be true. With strict flavor bans already in states like California, Massachusetts and New Jersey, many others want to join the flavor-ban train. Retailers in all states also know a potential federal ban is on the horizon.

Today, there is at least one vaping product and several modern oral nicotine products using some derivative of 6-methyl nicotine. Some of its supporters are saying it’s a billion-dollar market. Two industry financial analysts said the number seemed unlikely. Many retailers, manufacturers and industry-interested parties have recently learned about the presence of 6-methyl nicotine products and question the safety and market viability of the new nicotine analog.

Using 6-methyl nicotine is said to give users the same satisfaction that nicotine products offer. It also comes with a lower price point and isn’t hindered by the U.S. Food and Drug Administration’s authority over nicotine products. Brands using 6-methyl nicotine don’t (currently) have to go through the rigors of the FDA’s premarket tobacco product application (PMTA) process that nicotine products must.

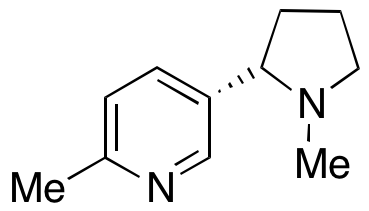

That doesn’t mean that 6-methyl nicotine products behave any differently than traditional nicotine products. They are not in the same “family,” but according to consumer research, the sensory effect and experience effects seem to be the same for the user. The 6-methyl nicotine molecule isn’t nicotine and doesn’t have any association with nicotine; however, its advocates say it does offer a user experience indistinguishable from nicotine.

The creation of synthetic nicotine analogs isn’t new. One of the earliest patents can be traced back to 1961 for a 6-methyl nicotinic acid registered by Phillips Petroleum Company. In the late 60s and early 70s, many of the major tobacco companies at the time were interested in developing a product that could potentially separate many of the negative health impacts of nicotine, such as its effects on blood pressure, that come along with the satisfaction of smoking.

According to Ed Carmines, chief scientific officer for Chemular, a regulatory consulting group, researchers attempted to discover the structural features of the nicotine molecule that were responsible for its various pharmacological properties. This led Philip Morris to discover one chemical, CR-1542, which appeared to show increased activity when compared to S-nicotine (the active molecule of nicotine).

The chemical was identified as (S) 6-methyl nicotine (6-MN). Scientists at R.J. Reynolds seemed to have a similar program, eventually forming Targacept, which later became an independent pharmaceutical company. “Early on in the research program at Philip Morris, before receptors were really known and understood, Philip Morris scientists were trying to figure out whether they could separate the good feeling you get from smoking from the increase in heart rate caused by nicotine.

“And they took the nicotine molecule, and they started changing it. And they changed it in about 80 different ways,” said Carmines. “Then they ran it through tests that responded to nicotine. There are some chemical assays and some biological assays. They basically found that 6-methyl nicotine was equally potent or potentially more potent than nicotine in these assays. The scientists were unable to separate this increase in heart rate from the good feeling you get from nicotine, and Philip Morris basically dropped the program.” The programs were dropped due to fears of added industry regulation at the time, according to records. Later, 6-methyl nicotine was rediscovered, and several companies began researching its current market potential.

Easy explanation

There are a few different brands of 6-methyl nicotine analogs on the market, including Imotine and Metatine. Carmines explained that the Imotine brand of 6-methyl nicotine is sold by a company called Novel Compounds based in Southern California. The brand is used in some 6-methyl nicotine modern oral products.

Charlies Holdings has exclusive rights to the chemical for vape products in the U.S. and sells 6-methyl nicotine under the brand Metatine. A limited survey of the current market only turned up one vaping device that offers 6-methyl nicotine, Spree Bar, owned by Charlie’s, which is a disposable flavored pod product line launched late last year.

Henry Sicignano, president of Charlie’s Holdings, parent to Spree Bar, speaking at an education seminar sponsored by Chemular at the Total Products Expo 2024 held in Las Vegas from Jan. 30 to Feb. 2, explained that, when vaped, Metatine provides the same sensations as traditional combustible tobacco products and nicotine vaping products.

“But because Metatine is not made or derived from tobacco, and because Metatine does not consist of or contain nicotine from any source, Spree Bar is not subject to FDA PMTA requirements,” said Sicignano. “This offers retailers an excellent vehicle for providing adult consumers with flavored vapes that do not violate federal regulations.

“Metatine is a synthetic molecule. It’s an analog that very closely resembles nicotine, but it is definitely not nicotine. Metatine has demonstrated no toxicity other than oral toxicity, very, very similar to nicotine. There are no additional side effects. The sensory experience is indistinguishable from that of nicotine vapes.”

There is a CAS Registry Number for 6-methyl nicotine. That means it is unique and specific to only one substance regardless of how many other ways it can be described, as far as regulators are concerned. Novel Compounds became interested in 6-methyl nicotine and asked Chemular and Carmines to help research alternatives that have been created to replace nicotine. After all, he was a tobacco scientist with nearly 30 years of experience in the industry.

Carmines said that there are several compounds that people have tried to market or bring to market. However, until 6-methyl nicotine was found, nothing really piqued his interest. “Metatine and Imotine, they both have the same genesis. In a nutshell, he said that both Novel Compounds and Charlie’s developed proprietary e-liquid bases that can serve in a one-to-one swap out for standard nicotine solutions in conventional vape and oral nicotine products,” he said.

Other than wanting to know if 6-methyl nicotine is safe, some other major industry concerns surrounding the molecule are its potency and its addictive properties. Nicotine mainly shows its action through specific nicotinic acetylcholine receptors located in the brain. It stimulates acetylcholine receptors, thus enhancing dopamine release in the brain, producing the feeling of pleasure.

“There are different kinds of receptors. The nicotine from a tobacco plant worked pretty well. So, tobacco companies never took it any further. But it turns out that for the receptor in the brain, there could be something that actually fits the receptor better. If you think about a key going into a lock, 6-methyl may fit it a little bit better than nicotine,” explains Carmines. “In truth, it is not clear whether 6-methyl nicotine ‘fits the lock better’ or if it simply gets absorbed a little bit better and gets to the brain a little bit faster because 6-methyl may be more soluble.”

The Spree Bar website states, “Metatine has been tested for tobacco-specific nitrosamines (TSNAs), degradants, chemical impurities, and other volatile organic compounds. The results indicate that Metatine likely poses no additional risk compared to additives found in conventional vape products currently on the market.”

A research paper presented at the 2023 Tobacco Science Research Conference states, “Imotine has been tested for tobacco-specific nitrosamines, degradants, chemical impurities and other volatile organic compounds. The results indicate that Imotine poses no additional risk than current vape and pouch additives on the market.”

Concerning the addictive properties of 6-methyl, Carmines said that the addictive properties should be nearly identical to nicotine (see “First Impression,” page 42). Even though 6-methyl nicotine is more powerful, in a vaping product, “strength” is regulated through dosage, much like traditional nicotine. With 6-methyl nicotine vaping products, the consumer gets the same impact that they get from vaping a 50 mg salt or a 5 percent salt nicotine product (such as a Bidi Stick).

“Adult consumers feel exactly the same. There’s less Metatine there,” he explains. “In terms of addiction potential, the addiction is really based on someone feeling good because they get nicotine in the brain. And 6-methyl nicotine is likely going to do exactly the same. It is not going to be less addictive. It’s not going to be more addictive. It’s going to interact with the same receptor and produce the same reward that people seek when they use nicotine.”

Retailer reasoning

There are several advantages to a retailer selling 6-methyl products. Carmines said that Novel Compounds had multiple law firms look at 6-methyl nicotine and concluded that Imotine does not fall under the authority of the Tobacco Control Act. It could be surmised that that applies to most 6-methyl nicotine products. The FDA also cannot designate 6-methyl nicotine as a drug if a manufacturer doesn’t make any health claims or imply the chemical is intended for use in the “cure, mitigation, treatment or prevention of disease,” according to the agency.

At some point, as the products grow in popularity or if they are misused, there is the potential for Congress to act to give the FDA authority over products containing 6-methyl nicotine. Synthetic nicotine had a similar experience. The FDA could have gone after synthetic nicotine as a drug, but it didn’t. Instead, the agency asked Congress to incorporate synthetic nicotine into the definition of a tobacco product under the Tobacco Control Act.

The FDA knows 6-methyl nicotine products are on the market. How the agency will react in the future is unknown. There are rumors that the agency considered adding nicotine substitutes/alternatives to the deeming rule but decided against it.

Many retailers are questioning why they should sell a nicotine substitute when traditional nicotine products are so readily available. Carmines said 6-methyl nicotine products may not fit into every market. Regulations for the vaping industry can change from state to state in the U.S. How flavor ban rules are worded and what products are impacted can also vary dramatically from state to state.

Depending on state legislation, several states ban electronic nicotine-delivery systems (ENDS), and some states write flavor laws differently. Some states specifically state “vaping products” while others may say “nicotine vaping products.” The regulations usually differ because they are meant to include cannabis vaping products.

“In California, Massachusetts, Rhode Island, two or three others that I can’t think of right now, [Spree Bar is] not legal because it’s a flavored vape device,” explains Sicignano. “In New York state, we are legal all across the state except the five boroughs of Manhattan. But by and large, I believe 44 states, we have a legal product because we are not an electronic nicotine-delivery system.”

For retailers in areas in states that have strict flavor bans, 6-methyl nicotine products can offer consumers more choices. Many retailers do not want to run afoul of the law and risk getting a warning letter or civil money penalty from the FDA. The single question remains: Why would a retailer sell 6-methyl nicotine products?

“Why would somebody use this product [Spree Bar]? I think it’s the availability of legal flavors and price. Flavors aren’t always available where consumers are purchasing. I think from a retailer perspective, it’s not taxed for the most part,” said Carmines. “So, you most likely have no federal or state excise tax on this since it is not a tobacco product. That is a big advantage for the consumer. Consumers can purchase a 6,000-puff Spree Bar refill for just $9.95. That is less than half the price of most nicotine vape products.”

Because it isn’t a tobacco product, 6-menthyl nicotine products have an advantage over traditional nicotine products. Flavored 6-methyl nicotine products can cost a lot less because it isn’t subject to skyrocketing nicotine taxes. In Washington, D.C., which has the second-highest tobacco tax rate at $5.03 per pack of 20 combustibles and vapor products are taxed at 80 percent of the wholesale price, 6-methyl nicotine products can easily be offered at a much lower price point.

“In approximately half the states in the (U.S.) that charge a nicotine tax, half, not all, but in about half of the states that charge a nicotine tax, [a 6-methyl nicotine product] is exempt,” said Sicignano. “It’s not nicotine. Minnesota, for example, has the highest nicotine vape tax rate at 95 percent; [6-methyl products are] not subject to the Minnesota tax. The product’s half as expensive before you start and is currently exempt from regulation …. I think that’s compelling.”