A new vaping product is slated to offer the cigarette-like flavor of combustibles with the ease of vaping.

By Timothy S. Donahue

It might be the most “wicked” thing to ever happen in the vapor industry. A new vaping device will enter the U.K. market this summer that brings together the taste and aroma of heat-not-burn products with the ease of use, mouthfeel and lowered risk offered by liquid-based vaping products. Developed by Avail Vapor founders James Xu and Donovan Phillips, the new FAV system hopes to be the ultimate transition device to trend combustible smokers toward less risky electronic nicotine-delivery system products.

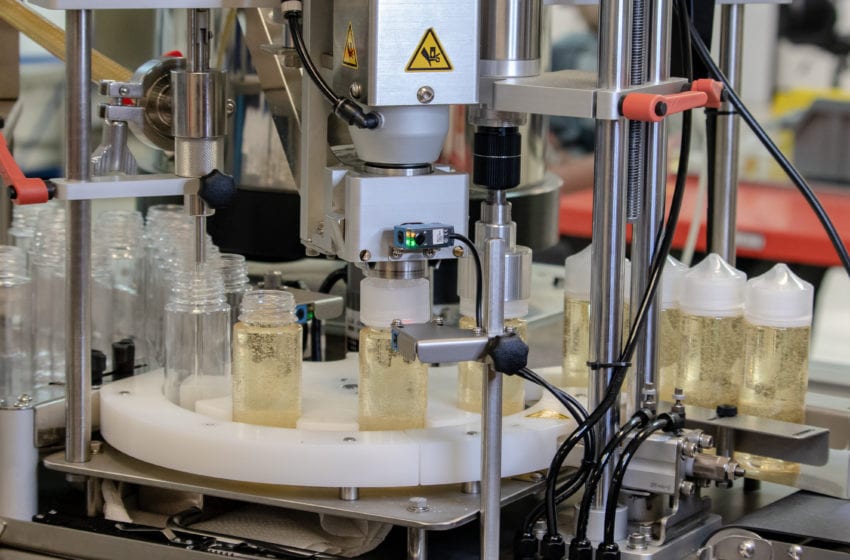

Xu and Phillips co-founded FAV Tech Hong Kong Limited with a leading Chinese hardware manufacturer to launch this new hybrid product, the FAV. What makes the FAV different is both its new wicking technology and its state-of-the-art microchip technology. Xu said the wicking is the first of its kind in the industry to use real tobacco leaf in the wick to help produce the tobacco flavoring in the atomized vapor. Xu uses proprietary patented technology to “sandwich” a layer of tobacco particulate in the cotton wicking used to absorb the e-liquid into the coil. The liquid is then atomized, and the heat releases the natural tobacco’s essence into the vapor as flavoring.

National data shows that at least two-thirds of combustible smokers try to quit each year. During his time with Avail, Xu said that shopper survey data showed that of those two-thirds of users, only six percent converted completely to vapor. That left 94 percent that continue to use traditional tobacco cigarettes. There had to be a better way to transition combustible smokers.

“It’s a scary experience for them to quit smoking because it’s a habit they form over many years. Any reason that they [combustible smokers] could find not to switch, such as it’s too complicated to use, it leaks or the flavor’s not there … They walk away from it or any other less harmful product,” explains Xu. “From the early days, we could see that there were certain ‘boxes’ that had to be checked to convert smokers. A convenient form factor, ease of use, but the one thing that was the most important was flavor.”

This knowledge sent Xu and Phillips on their journey to develop the FAV. Heated-tobacco products offered the touch and feel of combustibles, but they were complicated to use, and many users rejected the flavor. E-cigarettes were easier to use, but none offered the combustible cigarette flavor profile that nearly mimicked traditional tobacco cigarettes. The industry often said that if such a device was ever marketed, it could be the missing piece to the puzzle of tobacco harm reduction.

“When the smoker is first attempting to quit, it needs to be a lateral move. Something that tastes like combustible cigarettes,” said Xu. “For the smoker, taste is very important.”

Xu said the lightbulb moment happened when he was in China exploring factories with representatives of a global leaf supplier that explained how recon tobacco was created and used. Also known as homogenized tobacco recon (RTL), it was developed in the 1950s to save valuable raw material by combining remnants of virgin tobacco during production. RTL is a paper-like sheet approaching the thickness of tobacco laminae.

“They explained how they make recon paper. And that’s when we began to wonder if we could use recon paper near the heating coil so it can release the aroma. We later started to research how we could incorporate pure leaf into the cotton wicking existing in e-cigarette coils,” Xu said. “We devoted the last 12 months to perfect the process. We use real tobacco particulate. We can make infinite combinations to mimic all the different cigarette blends by using different leaves. It’s an extremely difficult and unique process to blend tobacco with cotton. The tobacco is ‘sandwiched’ in between the cotton fiber.”

The heat from the coil then releases the tobacco aroma into the vapor produced by the e-liquid passing through the cotton wicking and heating coil. The tobacco never burns, it just “heats” to release the flavor in the leaf blend mixed into the wicking. Xu said the concept is simple. To make it work, however, is quite the process.

“This wasn’t something we could do ourselves. We needed the assistance of scientists to help us be able to identify what particle size and layering process would actually work,” Xu said. “This is a specialized, unique and proprietary process.”

Technical response

An exceptional quality of the FAV is that the e-liquid used in the device contains only 3 percent tobacco essence boosters. Typical disposable vaping products contain between 20 percent and 36 percent flavoring. Xu didn’t disclose what flavoring was used, only saying it had no added sugars and only “enhanced” the flavor produced by the tobacco in the FAV’s wicking. Xu said the added flavoring “mimics other aspects of a combustible cigarette’s flavoring.”

Xu said that another innovation offered by the FAV is its microchip enhancement technology developed over many years with their Chinese partner. The chip embedded in FAV pods will not allow the device to be used without being activated at the store from which it’s purchased. This prevents any use unless the seller verifies the purchaser is of legal age to consume tobacco products. Xu acknowledges that there is little a manufacturer can do if devices are purchased by an adult, then given to an underage user (straw purchase). The technical enhancements, however, are aimed at combating underage nicotine consumption.

“The device can’t be stolen from a store and then used. It also prevents counterfeit products from becoming available. Only legitimate FAV pods work with the FAV battery device. The cartridge (pod) comes in the factory setting but can be modified by the user. Some users may want the wattage a little higher to squeeze out that last little bit of e-liquid. They have that ability to do that but within certain limits,” Xu explains. “Because many app platforms don’t allow tobacco product apps, users will have to initially connect the device to their computer to alter any settings.”

The device can also program puff counts for users who may be using the device to wean themselves off nicotine entirely. Xu said that the first version of the FAV will have a very limited set of options for users. “It’s going to be very limited because we need regulatory approvals on some options. However, the sky is the limit with the chip,” he said. “But if you tell me you want to quit smoking or vaping, we can program that. Today, you can have 100 puffs, tomorrow, 99; the day after tomorrow, 98. Everything can be stored in the chip.”

The FAV device has also performed better on toxicology testing than other heated-tobacco products. Xu said the FAV is equal to if not better than typical e-liquids as well because of the lack of flavoring and sugars in the e-liquid. There is little introduction of tobacco-specific nitrosamines (TSNAs) (which comprise one of the most important groups of carcinogens in tobacco products) or harmful and potentially harmful constituents (HPHCs) that are chemicals or chemical compounds in tobacco products or tobacco smoke that cause or could cause harm to smokers or nonsmokers.

“There are minute TSNAs or HPHCs present. FAV tests better than heat-not-burn by a significant amount and surpasses most vapor product testing because our cartridges/e-liquid use little flavoring. Additionally, the amount of tobacco equivalent to a pack of cigarettes is 12.4 grams for [an estimated] 300 puffs,” explained Xu. “We use 0.05 grams of tobacco in our wicking. It’s only a small fraction of real tobacco compared to a pack of cigarettes that’s needed to give that authentic taste.”

Xu said the FAV is expected to hit the European market this summer. The FAV is already TPD certified. The device has a 2 mL capacity with a 20 mg nicotine e-liquid mixed in a PG/VG base. It will come in three different tobacco flavors, and each flavor will have a menthol counterpart. Xu said he has submitted the FAV to Canadian authorities as well and expects to be able to enter that market sometime this year.

Concerning the world’s largest vaping market, Xu said he does want to submit a premarket tobacco product application (PMTA) to the U.S. Food and Drug Administration. He does, however, want to wait until the FDA gets the PMTA process in order and is clearer on what it expects from a vaping product to receive marketing approval. Xu said the FDA’s failure is costing the U.S. economy, limiting the technology of less risky tobacco products in the U.S. market and, most importantly, costing the lives of millions of smokers who want to quit but are unclear of the benefits of using less risky products.

“We identified the European market for our initial product launch. The FDA has this ludicrous regulatory environment. Initially, we were thinking about releasing FAV in the U.S. and manufacturing it in the U.S. This would have brought jobs and the first vaping hardware production to the Unites States,” said Xu. “We just couldn’t make it work because of the U.S. regulatory landscape. Because of the uncertainty with FDA regulation, we had no other choice but to choose production outside the U.S.”

There is one problem, however, that Xu hopes will never be solved: Focus group test panels seem to love the FAV. “The biggest problem we have right now is when we do a focus group test panel, and our testers are actual current combustible cigarette smokers, they don’t want to give me the FAV back,” he joked. “They just keep telling me, ‘This is exactly what we’ve being looking for.’ That’s a good problem; those individuals smoking combustible cigarettes don’t want to give it back. Maybe this is the unicorn device that makes the transition to less risky products easier.”