Altria Group, and its operating company, Njoy, disagree with the U.S. International Trade Commission (ITC) Administrative Law Judge’s (ALJ) initial determination regarding Juul Labs’ patent infringement complaint against NJOY.

Last week, the ALJ provided notice of their initial determination supporting Juul Lab’s allegations in its complaint and recommending an exclusion order prohibiting the importation of Njoy ACE into the United States.

“Altria and NJOY respectfully disagree with the ALJ’s initial determination, and NJOY looks forward to presenting its position to the full ITC, which is expected to issue a final decision by December 23, 2024,” a press release states.

In August 2023, Njoy filed a similar, independent patent infringement complaint against Juul Labs with the ITC seeking a ban on importing and selling JUUL products in the United States. A hearing before the ALJ was held in June 2024, and an initial determination is expected in late September. A positive outcome in this case would not preclude an exclusion order against ACE from taking effect.

“We continue to work to bring this issue to resolution. The parties have engaged with a mediator to attempt to negotiate a resolution of these disputes,” the release states. “In addition, Njoy recently filed Substantial Equivalence (SE) Exemption requests with the FDA to allow Njoy to market an already-developed ACE product with minor modifications that we believe avoid three of the four [Juul Labs] patent claims at issue in the case.”

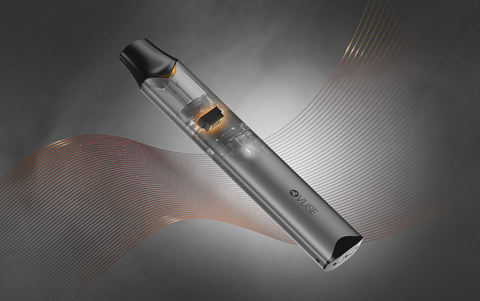

ACE is the first pod-based vaping product and the only pod-based menthol vaping product authorized by the U.S. Food and Drug Administration as appropriate for the protection of public health. “An exclusion order banning the importation of ACE would severely limit FDA-authorized choices for adults and undermine public health,” the release states.