Experts say Congress’ latest attempt to tax nicotine is complicated, confusing and harmful to public health.

By Timothy S. Donahue

To help pay for an infrastructure bill, the U.S. Congress has again introduced an excise tax on next-generation nicotine products, such as e-cigarettes and snus. The excise tax would apply to nicotine vapor products using both natural and synthetic nicotine as well as nicotine pouches. Experts say the provision, which would ultimately be paid by tobacco consumers, goes against U.S. President Biden’s campaign promise to not increase taxes on those making less than $400,000, negatively impact tobacco harm reduction efforts, increase sales of combustible tobacco products and boost an already growing black market.

The nicotine tax has been removed and reintroduced to Biden’s Build Back Better (BBB) legislation at least three times. The proposed vapor tax provision is now part of the latest version of the administration’s social spending and climate bill. According to Ulrik Boesen, a senior policy analyst with the Center for State Tax Policy at the Tax Foundation, taxes on tobacco and nicotine products tend to serve at least two purposes: to improve public health and raise revenue. He claims that a nicotine tax could do that if it is properly designed.

“A good design means internalizing externalities related to consumption of a product,” Boesen stated. “With tobacco and nicotine product consumption, these externalities are the health risks connected to frequent use and [the] quantity consumed. Nicotine is the addictive substance in the products but not the harmful ingredient. In other words, the proposal does not target the harmful behavior directly.”

Taxing based on nicotine content would favor low-nicotine liquids and could encourage increased consumption in the quantity of liquid, according to Boesen. “For example, a vapor pod that has a nicotine content of 3 percent and contains 1 mL of liquid would be taxed at $0.83 whereas a vapor pod that has a nicotine content of 5 percent and also contains 1 mL of liquid would be taxed at $1.39 even if there is no difference, or even a negative differential, in broader health effects of the two pods,” he states, adding that the effects of the tax are most substantial for nicotine pouches, such that the category is unlikely to survive.

Other estimates show that a 60 mL bottle of e-liquid with 12 mg of nicotine e-liquid would be taxed at $20.02. A four-pack of 8 mL pods with 5 percent nicotine salt pods would be taxed at $4.45 and a 15-pouch can of 8 mg nicotine pouches would be taxed at $3.34 (alongside state and local taxes, the cost of a single can could grow to $20 in some states).

Bryan Haynes, a partner with the law firm Troutman Pepper who specializes in tobacco and vapor regulations, said that, at a minimum, the proposed nicotine tax is “a hastily written addition” that will “have a negative impact on tobacco harm reduction efforts and public health.” He said that it’s the first time the tobacco industry has seen an excise tax placed on an ingredient instead of a finished good. “This is an unprecedented type of tax that will ultimately drive former smokers back to combustible products,” said Haynes, adding that taxing an ingredient could also cause unforeseen issues for manufacturers, such as moving material between factories.

“If a company is producing nicotine or even synthetic nicotine, moving product from one factory to another could trigger the need for an Alcohol and Tobacco Tax and Trade Bureau (TTB) license, and when product is removed, so to speak, from their factory, they would be responsible for remitting the taxes,” explained Haynes. “There may be a way, for example, if the company removed the nicotine from their factory and transported it in-bond to another TTB factory that you could make that work. But it’s just not clear. There is the potential for a lot of unforeseen issues to arise the way the tax is currently being proposed.”

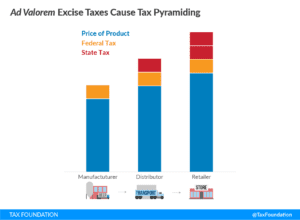

States often tax nicotine products by its cost. Boesen says the tax on the product will pyramid since the federal tax would be levied at the manufacturer level and the state tax is levied at the distribution level. “In effect, the state tax base includes the federal tax and becomes a tax on a tax. This means that even if the taxes on tobacco and other nicotine products are approximately equal at the federal level, by the time it reaches the consumer, the nicotine product will carry a higher tax (and often a higher price),” he states. “This is highly problematic when considering that cigarettes are much more harmful than nicotine products. That makes the federal tax proposal look like a harm-maximizing strategy.”

The bill also subjects synthetic nicotine products to the nicotine tax. Many in the industry have expressed concern that this provision could allow the U.S. Food and Drug Administration to assert authority over the substance. Synthetic nicotine is covered not only in the proposed tax bill but also in the Prevent All Cigarette Trafficking (PACT) Act, which bans the U.S. Postal Service from mailing any vaping products.

Azim Chowdhury, a partner at the law firm Keller and Heckman who specializes in vapor, nicotine and tobacco product regulation, said that’s just not possible and Haynes agrees. “The definition of a tobacco product in the Tobacco Control Act (TCA) is clear. It’s just not ambiguous; a product must be made or derived from tobacco, or a component or part of a tobacco product, to be a tobacco product,” said Chowdhury.

“Congress would have to change the Tobacco Control Act’s definition of a tobacco product in order to give FDA’s Center for Tobacco Products the authority to regulate synthetic nicotine products as tobacco products. That won’t happen overnight. I also see a scenario where synthetic nicotine could be regulated as a drug and that would be a whole different and more onerous regulatory regime.”

The FDA could, however, cite the inclusion of synthetic products in the PACT Act and the latest nicotine tax proposal in its lobbying efforts to change the TCA’s definition of tobacco, said Haynes. “I could see the FDA telling Congress, ‘You just amended the Internal Revenue Code to make these products subject to federal excise taxes just like tobacco-derived nicotine, so it’s not a big stretch to amend the Tobacco Control Act’ in the same way,” he explains. “That’s how I would do it. It’s not really a legal argument, but it could be a decent lobbying argument.”

It isn’t just vapers, business owners and attorneys that find fault with the proposed nicotine tax; researchers suggest the tax could also harm public health. Michael Pesko, an associate professor in the Department of Economics at Georgia State University, used a $1.4 million dollar grant from the National Institutes of Health (NIH) to conduct e-cigarette policy evaluation research, including the evaluation of e-cigarette taxes (Pesko receives no funding from the tobacco industry or related groups). Pesko found that e-cigarettes and other nicotine vaping products function as what economists call “substitutes” for conventional cigarettes.

“In practical terms, if e-cigarettes and cigarettes are substitutes, then raising the price of one on average leads people to increase use of the other. Given extensive peer-reviewed evidence indicating that these products are substitutes, an unintended but inevitable effect of increasing taxes on e-cigarettes is to increase cigarette use,” Pesko said. “Given that cigarettes are believed to be substantially more harmful than e-cigarettes, this effect on [combustible] cigarette use is concerning …. A wide array of research suggests that this boost in cigarette use as a result of large e-cigarette tax increases would significantly increase overall tobacco-related death and disease.”

These findings prompted Pesko to send a letter to Congress concerning the proposed vape tax. In the letter, he states that his research team’s economic evaluations of existing state and county e-cigarettes taxes found that increasing e-cigarette taxes to parity with the combustible cigarette tax rate would “sizably increase cigarette use across teens, adults and pregnant women compared to taxing tobacco products differentially in proportion to their health risk.”

Pesko said researchers found several concerning consequences of large e-cigarette tax increases:

- Simulating the current bill’s e-cigarette tax on teen tobacco use indicates that this policy would reduce teen e-cigarette use by 2.7 percentage points but that two in three teens who do not use e-cigarettes due to the tax would smoke cigarettes instead. This would result in approximately a half million extra teenage smokers overall. This finding that teens substitute to cigarettes in response to e-cigarette taxes has also been documented using National Youth Tobacco Survey data.

- The tax would raise the number of daily adult cigarette smokers by 2.5 million nationally and reduce adult e-cigarette users by a similar number.

- For every e-cigarette pod eliminated by an e-cigarette tax, more than 5.5 extra packs of cigarettes are sold instead.

- For every three pregnant women that do not use e-cigarettes due to an e-cigarette tax, one smokes cigarettes instead (study).

Pesko told Vapor Voice he was surprised to find that increased e-cigarette tax consistently resulted in substitution across various data sources. “And the magnitudes are fairly sizable,” he noted. “This is an unusual level of accordance for academic research.” Pesko believes that any tax on nicotine products should be based on quantity.

Boesen agreed. He stated that for vapor products, the “obvious choice” is taxing the liquid by volume (per mL), and for nicotine pouches, a tax by weight or per pouch is a straightforward solution. “It is the administratively simplest and most straightforward way for the federal government to tax these goods as it does not require valuation and as such does not require expensive administration,” he stated. “The nicotine tax proposal in the Build Back Better Act neglects sound excise tax policy design and by doing so risks harming public health. Lawmakers should reconsider this approach to nicotine taxation.”

Chowdhury said that the industry must do more and that interested stakeholders and consumers should reach out and push back on the nicotine tax because it will be devastating to the vapor industry. “It seems like the general industry feels like [this nicotine tax] won’t get through somehow, that some people will prevent it from being in the final bill, but I think it’s a huge risk,” said Chowdhury. “Without serious pushback, it could end up there; it could very well end up becoming law.”

Haynes said that if the nicotine tax bill ever makes it to Biden’s desk, “he’s going to sign it.”