ECigIntelligence predicts that the global vaping market grew by almost $2 billion last year.

By Freddie Dawson

Further regulatory restrictions on e-cigarettes are expected, but these will not prevent the global vaping market from continuing to grow in 2024, ECigIntelligence predicts. The trend is distinctly toward tightening controls on vaping products. Just eight of the nearly 60 countries and regions tracked by ECigIntelligence’s Policy Radar have a positive outlook on the political climate when it comes to alternatives to conventional cigarettes.

Yet despite this, ECigIntelligence sees the overall vaping market still growing by almost $2 billion between 2023 and 2024.

So notwithstanding increased regulation in many markets, there is still enough demand for alternatives to traditional cigarettes to fuel growth. Perhaps it is important to put that growth into context. An increase of just under $2 billion (from $26.4 billion to a predicted $28.3 billion) is the smallest rise not impacted by Covid-19 in the overall global market since the increase from 2016 to 2017.

The much newer, less established heated-tobacco market is now expected to overtake vaping with our sibling site TobaccoIntelligence predicting the heated-tobacco market will reach an estimated $28.6 billion in 2024.

So while there is still growth in vaping, it is by a lesser amount than it has been (particularly when viewed as percentage growth of the existing market). And other alternatives fueled by the seemingly limitless resources of Big Tobacco companies are quickly overtaking.

This makes 2024 something of a pivotal year for vaping, with important elections coming up in existing markets—such as those for members of European Parliament (MEPs) as well as contests in Belgium, India, Indonesia, Mexico, South Africa, South Korea and Taiwan—two of which could potentially be crucial for the future of the global vaping market.

Europe: Elections, Directive Revisions and Developments

Clearly, EU elections, covering the majority of European markets as they do, could have a massive impact on the future of vaping. However, their very multi-country nature makes them difficult to predict and influence—particularly on issues such as tobacco control, which would be a relatively minor campaigning point for the vast majority of politicians running.

Nevertheless, there is a chance a milder outlook on alternatives to conventional cigarettes will emerge, with right-wing/centrist parties such as the European People’s Party, European Conservatives and Reformists Party, and Identity and Democracy Party polling well.

These groups are less likely to support strict regulation, which would—at the least—maintain the status quo at a significant time for nonsmoking nicotine products as both the EU Tobacco Products Directive (TPD) and Tobacco Excise Directive (TED) will be revised.

For example, ECigIntelligence believes it unlikely a centrist/right-leaning EU would support a policy like banning all nontobacco flavors in vaping products. But given the MEP elections, ECigIntelligence does not believe much progress will be made on advancing policies in the TPD and TED.

Outside of elections, there are also a variety of other proposals expected to see significant developments through 2024, particularly in the areas of flavor bans and plain packaging as—in a continuation from 2023—fears over youth uptake of e-cigarettes continue to rise in more jurisdictions.

Focus on Australia Under Labor Government

In Australia, an overall new tobacco plan is also being drafted with the recently elected Labor government now taking control. Labor is thought to have a more skeptical view on the benefits of nonprescription nicotine products in smoking cessation, which could change how the country’s already delayed tobacco plan tackles these products.

This means that new regulations, such as a proposal to bring in plain packaging and a flavor ban for vaping products (regardless of nicotine content) as well as heated-tobacco products, could be adopted. Health warning requirements for vaping products are envisaged as well, and a ban on disposable vaping products is also expected to be in the bill.

Further measures could also be taken, such as a prohibition on the import of nicotine-free e-cigarettes (and limiting their sale to pharmacies only). However, there may be a chance conditions for prescribing e-cigarettes are eased—though that would be poor solace in comparison to the stringency of the other proposals.

Flavor Bans and Other Global Regulations

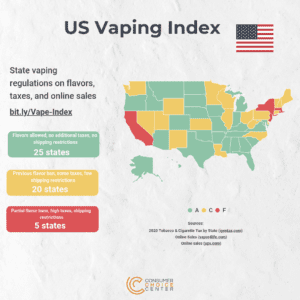

We could also see other countries enacting their own flavor bans. For example, Slovenia is expected to make such a move in 2024 while a proposal is under discussion in Canada that would limit e-liquid flavors to tobacco, mint and menthol.

ECigIntelligence thinks it is very likely that the Canadian ban will be approved, given it is government-backed and the measures proposed would not be considered controversial among the wider voting population. However, as it is still early stages in the formulation of the proposal, a date for when it would come in is not yet predictable.

Dutch authorities could move to introduce plain packaging—though it is unlikely the measure would enter into force in 2024 as it currently is only an adopted motion to take action.

The Netherlands is also looking at implementing retail regulations such as a registration obligation for all points-of-sale, which would be introduced in 2024. And, eventually, a generational ban on vapor products could be brought in.

A proposal to ban the sale of tobacco and related products, including e-cigarettes, in supermarkets as of July 2024 is expected. Sales will still be allowed after that at fuel stations, in convenience stores and in specialist shops. An effective date for the measure is not yet final. Entry into force is subject to its passing through the upper and lower houses of Parliament, which has not happened yet but is thought to be likely.

Ireland is also looking to limit the sales of vaping products. There, government officials will consider a ban on disposable vaping products in 2024. Results of a consultation showed almost 85 percent of participants supporting a ban. Such a move also appears to enjoy some government backing, with ministers expressing lukewarm support. However, such a move would have to be agreed on by government coalition members, and it may run into hurdles from EU single-market rules.

It will be interesting to see how these measures impact 2024 market estimates, such as those in Australia (expected to increase around $72 million to $478 million), Canada (expected to rise $50 million to $757 million), Ireland (only growing $4 million to $128 million) or the Netherlands (expected to fall $17 million to $160 million)—if they do indeed go forward in 2024.

Disposables are Still Big, China Losing Ground

It should be noted that disposables are the primary—and sometimes sole—category driving growth, so how regulation goes in 2024 is crucial to how growth in the overall vaping market develops. Intense media coverage of youth uptake and environmental issues is expected to continue and probably increase in most cases—also doing the market few favors.

Already, two major markets have announced bans on disposable products with both France and the U.K. moving forward with the intention to enact regulations to prohibit their sale.

Details on how the bans will be implemented as well as exact timescales remain light. In the U.K., the intention is for a ban to come into effect in 2025. But with an unpopular government, looming elections and other priorities, whether such a deadline will be made—or any deadline at all for that matter—is open to speculation.

In France, more details are clear as a bill has been approved by the country’s senate. Vaping products that cannot be refilled or are powered by a nonrechargeable battery would be prohibited under the new law, although no date for when the ban will come into effect has yet been announced. And the law must still face EU scrutiny on issues such as freedom of movement of goods.

A 2021 attempt by Belgium to ban disposables was met with a negative opinion from the European Commission. This was because the EU TPD—still in force, although currently under revision—prevents member states from prohibiting or restricting “the placing on the market of tobacco or related products, which comply with this directive.”

It seems unlikely that the European Commission could come up with a different opinion on a disposable vape ban in France, putting the plan still in the realms of uncertainty.

Nonetheless, ECigIntelligence expects to see a significant increase in the number of pre-filled and open pod category product launches as companies start to develop pod versions of disposable devices in line with incoming regulations in areas such as battery waste.

This will lead to some growth in user numbers in these categories—though the majority of that will only be down to cannibalizing off existing disposable category numbers.

Regulations are also likely to have an impact on the supply side of the market in 2024, with countries like Indonesia, Vietnam and Malaysia gaining importance in the area of hardware manufacturing.

This could potentially lessen the reliance of the sector on Chinese manufacturing—though it should be noted that the opinion of Chinese industry members is that such growth is more overspill from a crowded Shenzhen manufacturing scene rather than wholesale relocation of business to other markets due to factors like increased domestic regulations and duties in China.

Freddie Dawson is the managing editor for news at ECigIntelligence, a provider of detailed global market and regulatory analysis, legal tracking and quantitative data.

The European e-cigarette market is estimated to be worth €3.8 billion, and 3.1 percent of adults smoke e-cigarettes. The specialized vape shops are the prominent distributor. These were the major facts shared by Stavroula Anastasopoulou, senior market analyst for ECigIntelligence, a data provider for the global e-cigarette industry.

The European e-cigarette market is estimated to be worth €3.8 billion, and 3.1 percent of adults smoke e-cigarettes. The specialized vape shops are the prominent distributor. These were the major facts shared by Stavroula Anastasopoulou, senior market analyst for ECigIntelligence, a data provider for the global e-cigarette industry.