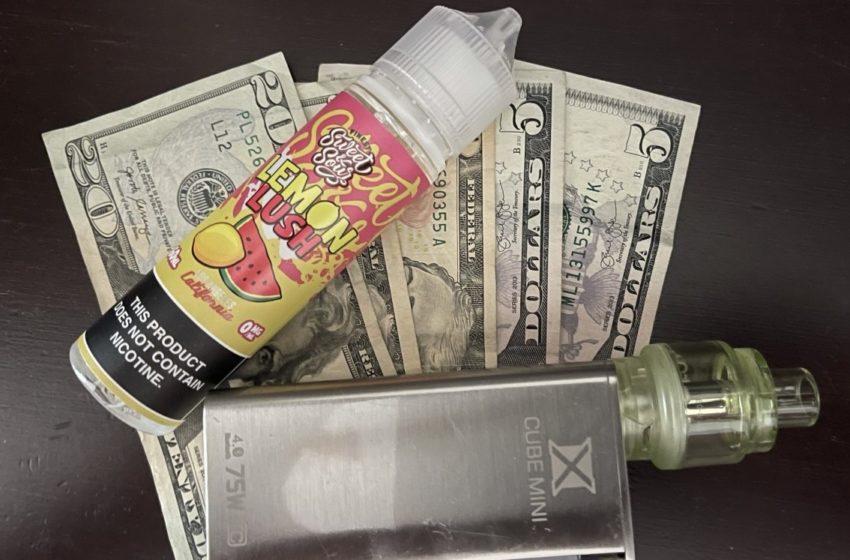

The U.S. Food and Drug Administration announced today it has authorized the marketing approval of three new vapor products to the RJ Reynolds (RJR) Vapor Company for its Vuse device and two tobacco-flavored pods It marks the first set of electronic nicotine-delivery system (ENDS) products ever to be authorized by the FDA through the premarket tobacco product application (PMTA) pathway. It also denied Vuse PMTAs for flavored products other than tobacco.

The FDA issued marketing granted orders for RJR’s Vuse Solo closed ENDS device and accompanying tobacco-flavored e-liquid pods, specifically, Vuse Solo Power Unit, Vuse Replacement Cartridge Original 4.8% G1, and Vuse Replacement Cartridge Original 4.8% G2.

The agency suggests the data submitted to the FDA by RJR demonstrated that marketing of these products is appropriate for the protection of public health. The authorization allows these products to be legally sold in the U.S.

“Today’s authorizations are an important step toward ensuring all new tobacco products undergo the FDA’s robust, scientific premarket evaluation. The manufacturer’s data demonstrates its tobacco-flavored products could benefit addicted adult smokers who switch to these products – either completely or with a significant reduction in cigarette consumption – by reducing their exposure to harmful chemicals,” said Mitch Zeller, director of the FDA’s Center for Tobacco Products. “We must remain vigilant with this authorization and we will monitor the marketing of the products, including whether the company fails to comply with any regulatory requirements or if credible evidence emerges of significant use by individuals who did not previously use a tobacco product, including youth. We will take action as appropriate, including withdrawing the authorization.”

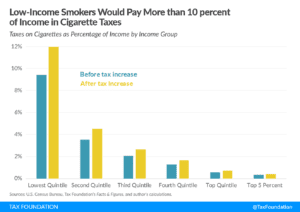

Under the PMTA pathway, manufacturers must demonstrate to the agency that, among other things, marketing of the new tobacco product would be appropriate for the protection of the public health. These products were found to meet this standard because, among several key considerations, the agency determined that study participants who used only the authorized products were exposed to fewer harmful and potentially harmful constituents (HPHCs) from aerosols compared to users of combusted cigarettes, according to a release.

“The toxicological assessment also found the authorized products’ aerosols are significantly less toxic than combusted cigarettes based on available data comparisons and results of nonclinical studies. Additionally, the FDA considered the risks and benefits to the population as a whole, including users and non-users of tobacco products, and importantly, youth,” the release states. “This included review of available data on the likelihood of use of the product by young people. For these products, the FDA determined that the potential benefit to smokers who switch completely or significantly reduce their cigarette use, would outweigh the risk to youth, provided the applicant follows post-marketing requirements aimed at reducing youth exposure and access to the products.

The FDA also issued 10 marketing denial orders (MDOs) for flavored ENDS products submitted under the Vuse Solo brand by RJR. Due to potential confidential commercial information issues, the FDA is not publicly disclosing the specific flavored products.

These products subject to an MDO for a premarket application may not be introduced or delivered for introduction into interstate commerce. Should any of them already be on the market, they must be removed from the market or risk enforcement. Retailers should contact RJR with any questions about products in their inventory. The agency is still evaluating the company’s application for menthol-flavored products under the Vuse Solo brand.

“Additionally, today’s authorization imposes strict marketing restrictions on the company, including digital advertising restrictions as well as radio and television advertising restrictions, to greatly reduce the potential for youth exposure to tobacco advertising for these products,” the release states. “RJR Vapor Company is also required to report regularly to the FDA with information regarding the products on the market, including, but not limited to, ongoing and completed consumer research studies, advertising, marketing plans, sales data, information on current and new users, manufacturing changes and adverse experiences.

The FDA may suspend or withdraw a marketing order issued under the PMTA pathway for a variety of reasons if the agency determines the continued marketing of a product is no longer “appropriate for the protection of the public health,” such as if there is a significant increase in youth initiation. While today’s action permits the products to be sold in the U.S., it does not mean these products are safe or “FDA approved.”

The agency will continue to issue decisions on applications, as appropriate, and is committed to working to transition the current marketplace to one in which all ENDS products available for sale have demonstrated that marketing of the product is “appropriate for the protection of the public