RLX Technology reported net revenues of RMB551.6 million ($76.4 million) in the first quarter of 2024, up from RMB188.9 million in the same period of 2023. Gross margin was 25.9 percent, compared with 24.2 percent in the 2023 period. U.S. GAAP net income reached RMB132.6 million, compared with U.S. GAAP net loss of RMB56.3 million in the same period of 2023.

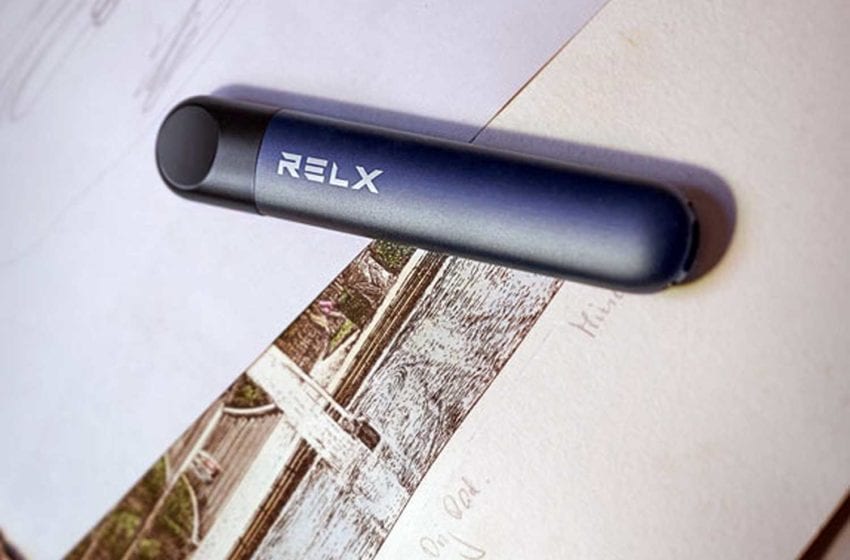

“We started 2024 with a steady first quarter,” said Ying (Kate) Wang, co-founder, chairperson and CEO of RLX Technology in a statement. “Our international business is developing positively as we refine our regional strategies. Despite challenges posed by regulatory changes across various regions, we continue to identify opportunities and leverage our core strengths to prudently enter potential markets.

“Domestically, we are encouraged by the positive impact of China’s recent regulatory crackdown on illegal products, but much progress remains to be made. We remain committed to collaborating with regulators and advocating for a well-regulated and healthy e-vapor industry. As a trusted e-vapor brand for adult smokers, we are dedicated to optimizing our product portfolio with premium, compliant, and innovative products that meet our users’ needs and drive growth in this evolving industry.”

The first quarter marked RLX Technology’s fifth consecutive quarter of sequential revenue growth, according to Chief Financial Officer Chao Lu. “With our resilient business model, effective regional strategies, and consistent strong execution, we are confident of sustaining this growth trajectory and delivering sustainable value to our stakeholders,” he said.

ADS[2] were RMB0.166 (US$0.023) and RMB0.159 (US$0.022), respectively, in the first quarter of 2024, compared with non-GAAP basic and diluted net income per ADS of RMB0.139 and RMB0.136, respectively, in the same period of 2023.

Turning Point Brands reported net sales of $109.9 million in the third quarter of fiscal 2021, up 5.5 percent over that of the previous year’s third quarter. Gross profit increased 12.3 percent to $54.3 million and net income increased 49.3 percent to $13.4 million.

Turning Point Brands reported net sales of $109.9 million in the third quarter of fiscal 2021, up 5.5 percent over that of the previous year’s third quarter. Gross profit increased 12.3 percent to $54.3 million and net income increased 49.3 percent to $13.4 million.