Altria Group reduced the value of its investment in Juul Labs by nearly 70 percent, to $1.3 billion, following the Food and Drug Administration’s decision to order the e-cigarette company off the U.S. market.

The stake for which Altria paid $12.8 billion in 2018 is now valued at $450 million–below a level that allows Altria to exit a noncompete agreement and launch its own e-cigarettes. During a July 28 call with analysts and reporters, Altria said it had opted not to be released from that agreement because the arrangement was still beneficial to Altria.

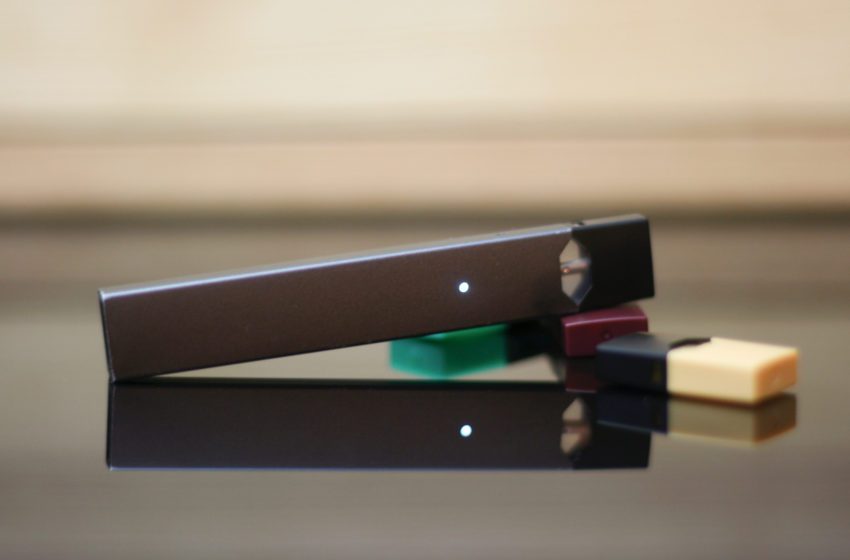

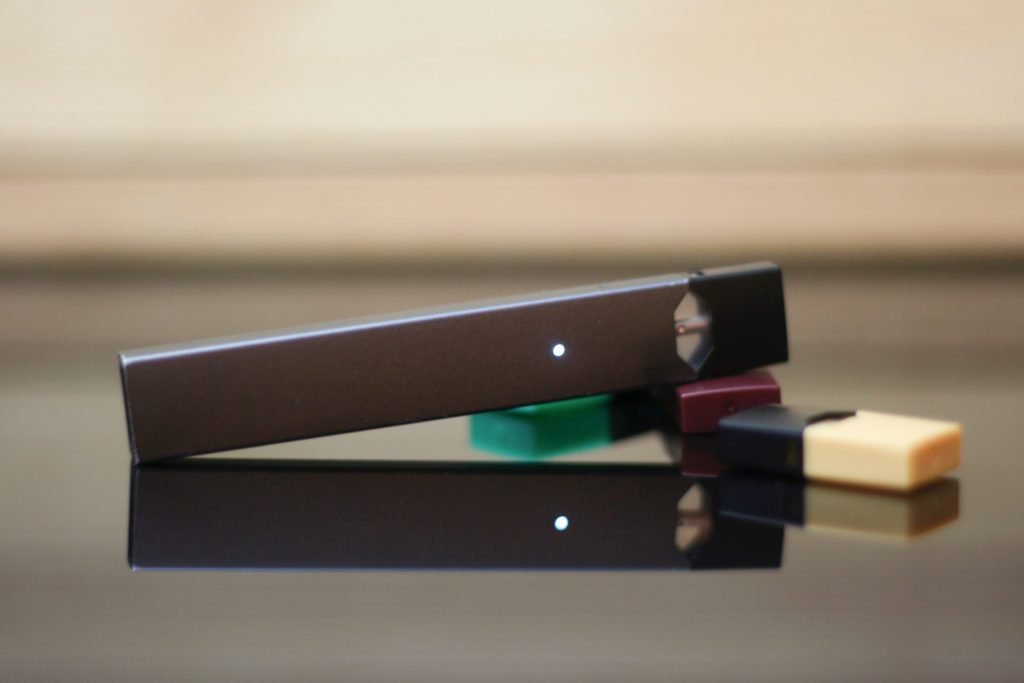

On June 23, the FDA ordered Juul Labs to pull its e-cigarettes from U.S. store shelves, saying the e-cigarette manufacturer had submitted insufficient evidence that they were “appropriate for the protection of the public health.”

A federal appeals court then granted Juul Labs a emergency stay of the order to give the judges time to evaluate the merits of Juul’s appeal. The e-cigarette company separately asked the FDA to stay its own order pending the appeal, and the agency complied.

In court filings last month, Juul said the FDA overlooked more than 6,000 pages of data the company had submitted on the aerosols that users inhale.

On July 5, the FDA temporarily halted its ban on Juul Labs products, saying there were scientific issues unique to the Juul application that warrant additional review.

The agency stressed that the stay suspends but does not rescind it the marketing denial order while the e-cigarette maker appeals the agency’s decision.

Altria’s revenue fell 4.1 percent to $12.44 billion in the first half of 2022, as consumers facing high inflation bought fewer cigarettes or switched from premium to discount brands.

Despite the challenges, Altria CEO Billy Gifford, was pleased with the results.

“Our tobacco businesses performed well in a challenging macroeconomic environment for the first half of the year,” he said in a statement. “The smokeable products segment delivered solid operating companies income growth behind the resilience of Marlboro, and our moist smokeless tobacco brands continued to drive profitability.

“Our financial plans for the year remain on track, and we reaffirm our guidance to deliver 2022 full-year adjusted diluted EPS in a range of $4.79 to $4.93.”