Chicago-based e-liquid manufacturer Gripum had its lawsuit come before the Seventh Circuit on Wednesday morning, arguing it is the victim of regulatory malfeasance. The panel did not say when a decision would be reached.

Gripum markets vaping products under a number of different brand names. In September 2021, the U.S. Food and Drug Administration denied Gripum’s applications to enter its products into interstate commerce on the grounds that the products would induce more youth to start vaping than they would help adult combustible users to drop traditional cigarettes.

“All of [Gripum’s applications] lack sufficient evidence demonstrating that [their] flavored [vapes] will provide a benefit to adult users that would be adequate to outweigh the risks to youth,” the FDA’s rejection order stated.

Gripum argues the rejection was improper because the FDA had used unclear standards to evaluate the company’s products and its conclusion was based on a selective reading of the available research into e-cigarette use, according to Courthouse News. The company specifically claims it should not have been penalized for not including long-term longitudinal studies of vape use in its applications, as the FDA did not state Gripum had to include such studies when it first submitted its applications in September 2020.

“FDA repeatedly assured manufacturers that their [applications] would not need to include long-term studies (random controlled trials or longitudinal cohort studies). Gripum took FDA at its word,” the company’s brief to the Seventh Circuit states. “FDA, however, employed a secret ‘fatal flaw’ inquiry: it did not conduct an individualized review of the substance of Gripum’s [applications] once it observed the absence of long-term studies.” (Parentheses in original).

The company also says the FDA ignored studies showing that youth smokers typically preferred “closed-system” flavored tobacco products, a separate technology from the “open-system” vapes Gripum sold. Closed-system vapes such as Juul pods mimic traditional cigarettes in form and contain tobacco liquids with a high nicotine concentration to compensate for their small size and short battery life. Open-system vapes, by contrast, are larger devices using refillable tobacco liquid cartridges with a lower nicotine concentration. According to Gripum’s brief, these open-system vapes are generally preferred by adult smokers in their 40s, regardless of flavor.

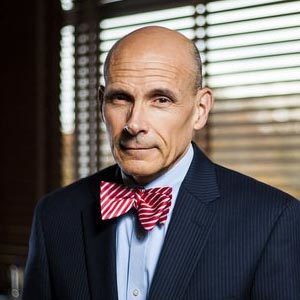

Following this reasoning, Gripum’s attorney J. Gregory Troutman argued Wednesday that the company’s products, if allowed into interstate commerce, would help adult smokers quit traditional cigarettes more than they would attract young people in their teens or 20s. Getting people off traditional smokes is one element of the FDA’s evaluation criteria, given that the agency considers vaping relatively less harmful than traditional tobacco products for adult users.

“We take the agency and its representatives at the public statements they’ve made, where they’ve talked about these products as less harmful,” Troutman said. “That’s the real rub here.”

The three-judge panel was skeptical of this line of argumentation, however, given that the FDA’s statements referred to e-cigarettes in general and not Gripum’s products particularly.

“You don’t have any evidence that your products are going to induce adults to stop using [cigarettes] that I saw,” said U.S. Circuit Judge Diane Wood. “That’s half the equation.”

Troutman conceded that Gripum, in its applications, had not presented any evidence to the FDA that its specific products would help stop traditional tobacco use among adults. But he argued this is irrelevant given the studies it did provide the FDA, which showed e-cigarettes in general do lower the rate of traditional tobacco product use among adults.

U.S. Circuit Judge David Hamilton remained unmoved by this argument. He questioned Troutman as to why Gripum had not distinguished between its flavored and non-flavored vapes when filing its applications, given youths’ potential preference for flavored products. Troutman again laid blame for the oversight at the FDA’s feet.

“That was not something that we were told we had to do prior to the application deadline,” Troutman said.

The response did not impress Hamilton, who rebutted that the FDA was authorized to use its own discretion in approving products for market. After Troutman conceded that the FDA has not yet cleared any flavored vape product in the U.S. for interstate commerce, Hamilton said the FDA rejecting Gripum’s application “sounds pretty consistent.”

The judges were more sympathetic to the arguments put forward by the FDA. In both in its brief and via its attorney Kate Talmor, the agency said flavored vapes required further study before they could be approved for the market.

“FDA has granted applications to market certain tobacco-flavored e-cigarettes based on evidence that youth use of tobacco-flavored products is limited and that such products may help adults switch from combustible cigarettes,” the FDA’s brief states. “But for e-cigarettes with flavors other than tobacco, ‘the risk of youth initiation and use is substantial’ and well documented.”

Talmor added that the rejection of Gripum’s applications was “not a de facto ban” of all flavored vape products. Gripum, she said, simply failed to show that its products were more beneficial to adults than they were seductive to young people.

“Gripum failed to submit any evidence in its application demonstrating benefits from its products to adults,” Talmor told the panel.

She pointed out that there are many flavored vape products currently in markets across the U.S. with legally murky status, subject to FDA enforcement discretion. There are also several applications for flavored vape products from other manufacturers that are currently in consideration. In time and with further study, Talmor said, these applications may be approved.

When pressed by Wood regarding Gripum’s complaint that it was penalized for not including longitudinal studies that it was never advised it had to include, Talmor dismissed this as the company being obtuse. She argued the agency gave the whole e-tobacco industry a heads up in 2019 that it would be looking for “robust” evidence of flavored products’ public health benefits in any market application.

“Looking at the [2019] guidance as a whole, it plainly advised industry that they were going to need robust evidence to demonstrate the benefits of their products outweigh any harms,” Talmor said.

Talmor concluded her arguments by saying that the FDA had to be granular – Gripum, she argued, cannot use generalized research into e-tobacco products as the sole basis for asking that its own specific products be approved. If it could, she said, the FDA would have to allow far more potentially unsafe vape products onto the market than it currently does.

“Gripum… did not attempt to submit evidence that was specific to its products and made the required showing,” Talmor said. “And I just don’t think there’s any way to look at the 2019 guidance and conclude that could possibly meet [the guidance’s] standard.”

The panel – rounded out by the mostly silent U.S. Circuit Judge Thomas Kirsch – took the arguments under advisement but did not say when they would issue a ruling.

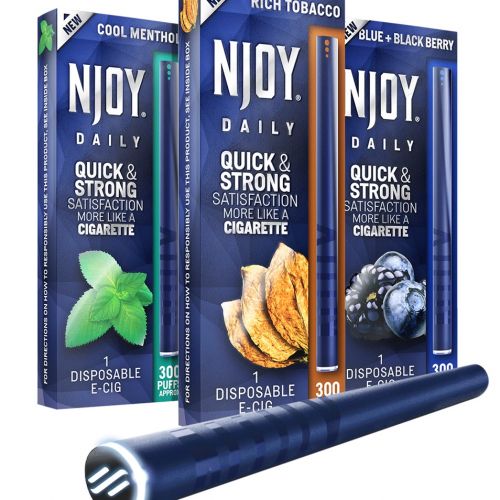

The U.S. Food and Drug Administration on April 26 authorized four NJOY products through the premarket tobacco product application (PMTA) pathway. The FDA issued marketing granted orders to NJOY for its Ace closed e-cigarette device and three accompanying tobacco-flavored e-liquid pods—NJOY Ace Pod Classic Tobacco 2.4%, NJOY Ace Pod Classic Tobacco 5% and NJOY Ace Pod Rich Tobacco 5%.

The U.S. Food and Drug Administration on April 26 authorized four NJOY products through the premarket tobacco product application (PMTA) pathway. The FDA issued marketing granted orders to NJOY for its Ace closed e-cigarette device and three accompanying tobacco-flavored e-liquid pods—NJOY Ace Pod Classic Tobacco 2.4%, NJOY Ace Pod Classic Tobacco 5% and NJOY Ace Pod Rich Tobacco 5%.