RLX Technology revenue slowed in the second quarter of 2020 amid uncertainty about the regulatory environment in China.

Net revenues were RMB2.54 billion ($393.6 million), representing an increase of 6 percent from RMB2.4 billion in the first quarter of 2021. The improvement was due primarily to an increase in net revenues from sales to offline distributors, which was mainly attributable to the expansion of the company’s distribution and retail network.

The company believes that the slowdown in quarterly sequential revenue growth was due primarily to external factors, including negative publicity on the vapor industry in the latter half of the second quarter, coupled with the fact that the draft new rules for vapor products announced by China on March 22, 2021, have not been formally confirmed and no new implementation details had been revealed, which had an adverse impact on sales.

The company is also target of a lawsuit by investors who claim RLX Technology overstated its financials and misrepresented potential regulatory risks when it filed the paperwork for its initial public offering in the U.S.

Gross margin was 45.1 percent compared to 46 percent in the first quarter of 2021.

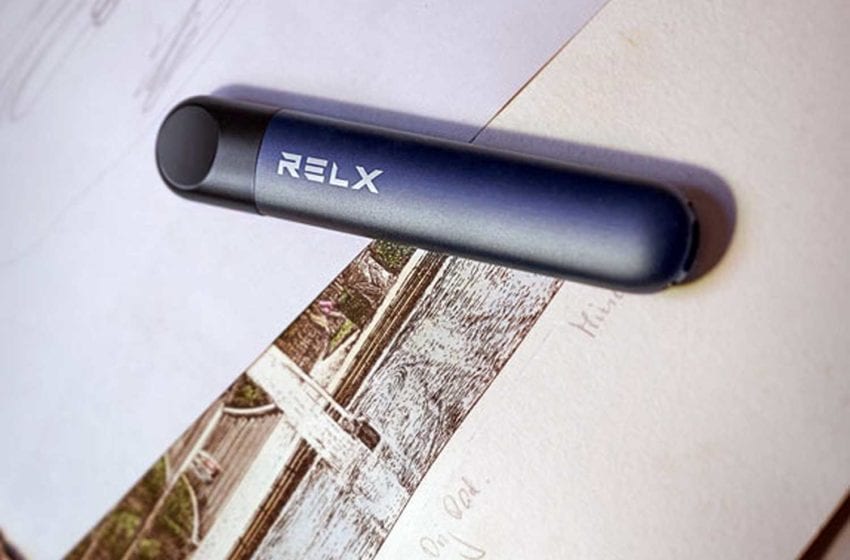

“In the second quarter of 2021, our business continued to develop as we increased our efforts to further improve underage protection and product safety,” said Ying (Kate) Wang, co-founder, chairperson of the board of directors and CEO of RLX Technology, in a statement. “With our strategic focus on technology investment and brand building, we strive to make RELX a trusted brand for adult smokers with state-of-the-art products, industry-leading technologies and scientific advances. Going forward, we will further enhance investments in scientific research, strengthen our distribution and retail network, and improve our supply chain and production capabilities to create more value for our users and shareholders alike.”

RLX hosted an earnings conference call on Aug. 20, 2021. A live and archived webcast of the conference call is available on the company’s investor relations website. A replay of the conference call will be accessible until Aug. 27, 2021.