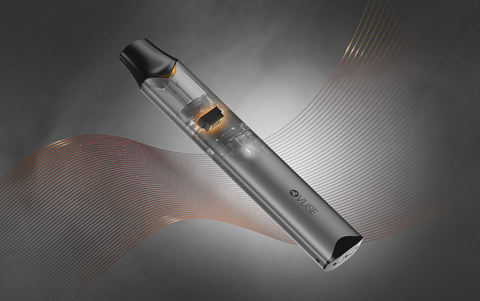

The R.J. Reynolds Vapor Co. and its Vuse brand e-cigarette continues to gradually grow its U.S. market-share lead over Juul.

Vuse’s market share rose from 35.1 percent to 35.5 percent, compared with Juul declining from 33.1 percent to 32.9 percent, according to the latest Nielsen analysis of convenience-store data that covers the four-week period ending June 18.

It is the first Nielsen report since the U.S. Food and Drug Administration announced Thursday that Juul Labs would be required to remove all of its e-cigarette products from U.S. shelves. The U.S. Court of Appeals for the D.C. Circuit on Friday granted Juul Labs an emergency administrative stay of enforcement.

For the latest report, NJoy dropped from 3 percent to 2.9 percent, while Fontem Ventures’ blu eCigs slipped from 1.9 percent to 1.7 percent.

The decision to remove the No. 2-selling electronic cigarette in the country will likely to lead to a dominant market share for Vuse products. However, for the past 52 weeks, Juul remains ahead 35.1 percent to 31.2 percent, according to the Winston-Salem Journal.

“Having received the emergency temporary stay, we are now seeking the ability to continuously offer our products to adult smokers throughout our appeal with the court and science- and evidence-based engagement with our regulator,” Joe Murillo, Juul Labs’ chief regulatory officer, said Tuesday. “We remain confident in our science and evidence and believe that we will be able to demonstrate that our products do in fact meet the statutory standard of being ‘appropriate for the protection of the public health.’ “

Nielsen largely covers larger chain stores and doesn’t track local vape shop sales. For the smaller chains, the group extrapolates trends, which is why trend changes don’t appear immediately in Nielsen, such as the rise of disposable products.

Nielsen determined that Vuse recaptured the top market share in the April 23 report. That was the first time Vuse held the top market share in the Nielsen report since November 2017.

Juul’s four-week dollar sales in the latest report have dropped from a 50.2 percent increase in the Aug. 10, 2019, report to a 12.2 percent decline in the latest report.

By comparison, Reynolds’ Vuse was up 40.5 percent in the latest report, while NJoy was down 14.1 percent and blu eCigs down 27.9 percent. Goldman Sachs analyst Bonnie Herzog has said that NJoy “refutes Nielsen’s data and methodology.”

Another factor is that e-cigarette sales overall have slumped since February 2020, when the FDA implemented its latest round of heightened regulations on the products.