The U.S. Food and Drug Administration authorized the marketing of seven e-cigarette products in the United States through the premarket tobacco product application (PMTA) pathway.

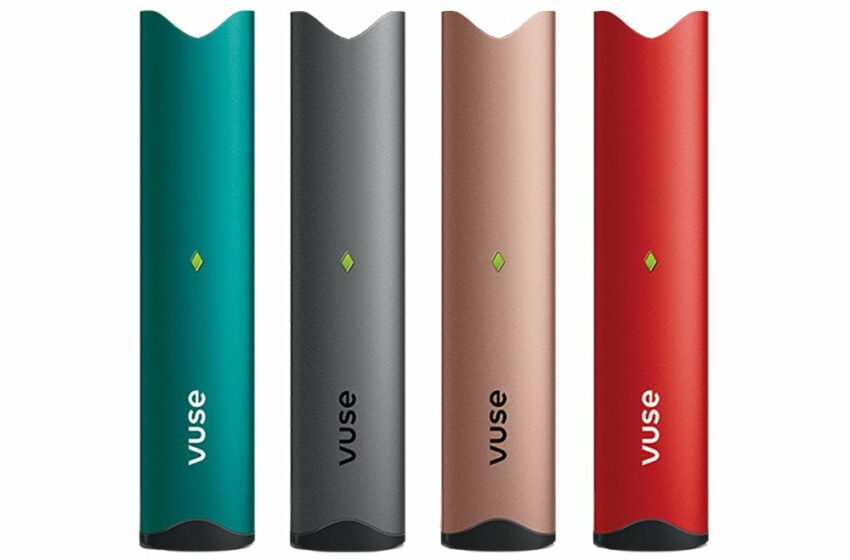

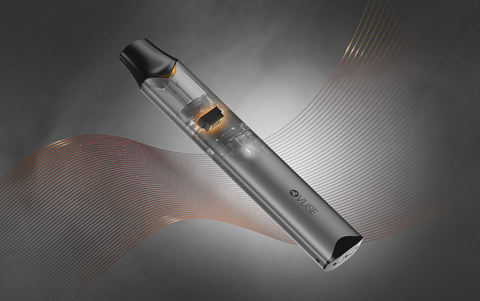

Following an extensive scientific review, FDA issued marketing granted orders to R.J. Reynolds Vapor Co. for the Vuse Alto Power Unit and six Vuse Alto tobacco-flavored pods, which are sealed, pre-filled, and non-refillable:

- Vuse Alto Pod Golden Tobacco 5%

- Vuse Alto Pod Rich Tobacco 5%

- Vuse Alto Pod Golden Tobacco 2.4%

- Vuse Alto Pod Rich Tobacco 2.4%

- Vuse Alto Pod Golden Tobacco 1.8%

- Vuse Alto Pod Rich Tobacco 1.8%

While the FDA says it remains concerned about the risk of youth use of all e-cigarettes, youth are less likely to use tobacco‐flavored e-cigarette products compared to other flavors.

According to the 2023 National Youth Tobacco Survey, Vuse was among the most commonly reported brands used by middle and high school students currently using e-cigarettes.

However, only 6.4 percent of students who currently used e-cigarettes reported using tobacco‐flavored products. To further mitigate youth use of these products, FDA has placed stringent marketing restrictions on the new products in an effort to prevent youth access and exposure.

The FDA has received applications for nearly 27 million deemed products and has made determinations on more than 26 million of those applications. To date, the agency has authorized 34 e-cigarette products and devices, including the seven authorized today.

A list of all authorized e-cigarette products is available here.